- Summary:

- Crude oil price rises on Monday, as OPEC + is expected to maintain its scheduled increase quota at this week's meeting.

Crude oil prices returned to winning ways on Monday, with the Brent benchmark inching 1.46% higher to $84.84. The rise in oil prices follows a slight correction from the stellar performance of September and October and comes as the OPEC + cartel is expected to ignore the calls of US President Joe Biden to boost supply to cool off prices.

The OPEC + alliance meets later this week to decide on new quotas going forward. The US President had called on OPEC members with spare capacity to boost production. However, the cartel is believed to want to stick to its scheduled output increase by 400,000 barrels a month, as agreed in its last meeting.

Prices of crude oil had risen steeply on stronger-than-expected demand and were also triggered when Hurricane Ida knocked off 50% of the supply from the Gulf Coast two months ago.

An earlier-onset and colder winter could put additional pressure on prices.

Crude Oil Price Outlook

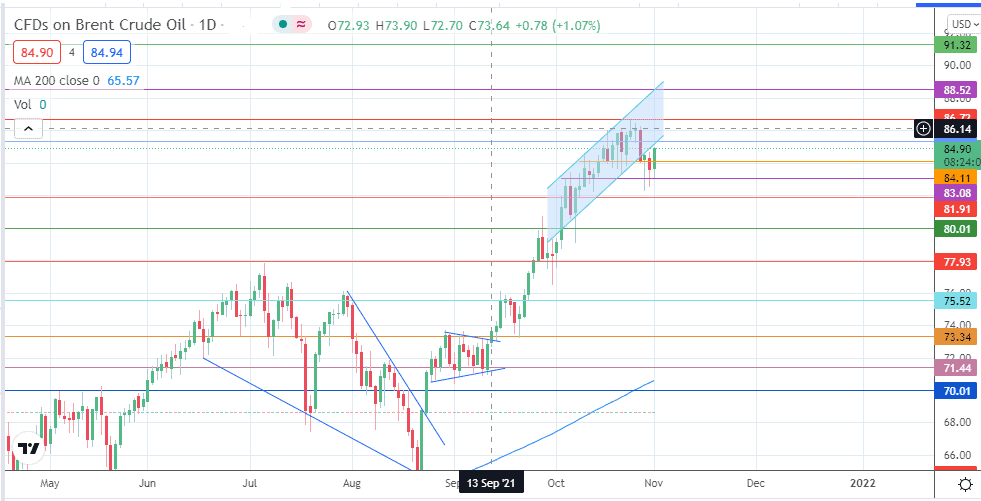

Monday’s rise is a return move that tests the lower border of the broken channel and the 85.32 resistance. Rejection at this point continues the downward push towards 84.11 and 83.08. Price needs to break the lows of the last three candles to attain the 81.91 support, below which 80.00 (psychological price mark) comes into play.

On the flip side, a return of the uptrend follows a break of the multi-year high at 86.72. This move needs to take out 85.32, setting its sights on 7-year highs at 88.52 and 90.00. 91.32 could also come into view if the advance is more pronounced.

Brent Crude: Daily Chart