- Summary:

- Crude oil price bearish outlook as OPEC slashes demand levels for both 2020 and 2021. The technical perspective looks bearish too.

Crude oil price rejection at the $40 level comes as a reaction to changes in supply and demand but also as a result of OPEC’s recent bearish market report. The industry faces an existential crisis as the world’s economic growth collapsed, and so does the demand for oil products.

OPEC Slashes Estimates for Oil Demand

A recent release from OPEC shows that the cartel it is revising down its estimates for oil demand for both 2020 and 2021. As such, the organization cut the 2020 demand outlook by 400,000 b/d and slashed its 2021 demand estimates by700,000 b/d.

In such a context, the crude oil price has a difficult time advancing, especially as global economic growth is non-existent in 2020.

Bleak Outlook for Global Growth

With the exception of China, the global economy is expected to decline all over the world. A slowdown affects shipping, global trade, and oil consumption.

OPEC had a hard time mobilizing other oil-producing members and delivering universal production cuts to prop up the price of oil from the negative territory reached in April. With slow economic growth, it may need to deliver some more cuts.

Moreover, a democrat win in the upcoming U.S. Presidential election will likely result in a new round of negotiations with Iran. If Iran oil hits the market, the crude oil price will have to reflect another 2.5 million b/d.

Crude Oil Price Technical Analysis

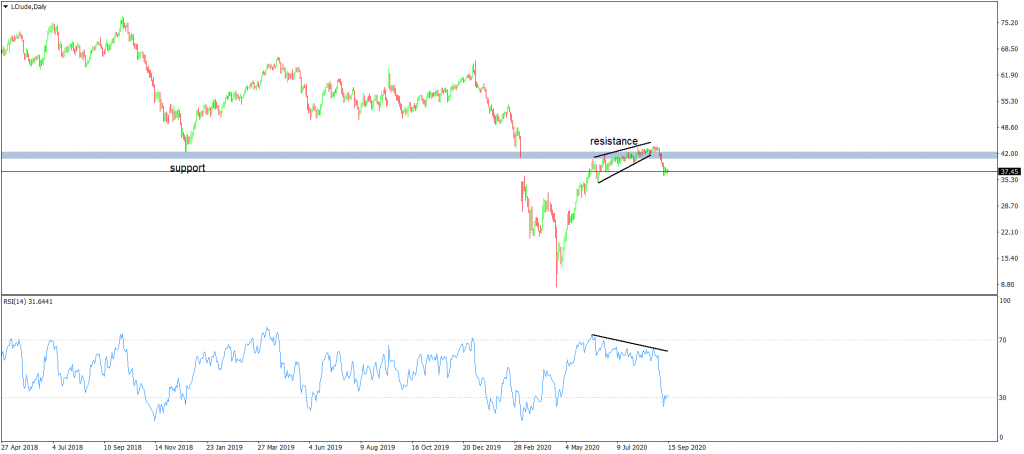

For the entire summer, the crude oil price hovered around the $40 level. It met resistance on previous support level and formed multiple reversal patterns. First, it formed a rising wedge against resistance – a bearish sign seen for the entire summer. Second, the oil price formed a bearish divergence with the RSI, another bearish sign suggesting that oil will eventually be rejected above $40. It did.

Bears would like to see more continuation. As such, a bearish scenario requires a stop loss at the highest point in the rising wedge and a take profit at 50% of the wedge’s length. It means an entry at market, with a stop loss at $43.80 and a target at $23.50.

To learn more about trading commodities, consider enrolling in our trading coaching program.

Crude Oil Price Forecast