- Summary:

- crude oil price is paring back some of the losses it endured on Monday as investors remained optimistic that the supply and demand imbalance

The crude oil price is paring back some of the losses it endured on Monday as investors remained optimistic that the supply and demand imbalance will push the prices higher. Brent, the global benchmark, rose to $84.68 while West Texas Intermediate (WTI) rose to $82.

Why oil prices are rising

Crude oil and other base commodities like copper and iron ore prices have been in a bullish trend this year as investors bet on the first supercycle in years.

Oil has risen as investors price in more demand for the commodity at a time when supply is struggling. In a meeting earlier this month, OPEC+ said that it will increase production by just 400k barrels per day until 2022. This increase was lower than what was needed to keep prices stabilized.

At the same time, oil demand is rising. For one more countries have been forced to start using generators to power their electric grid now that coal and gas prices have rocketed higher. Also, more airlines are flying, leading to more demand. More people are also going to work and taking long trips to compensate the many months they were in lockdown.

As a result, the most optimistic estimate is that oil demand will rise to more than 100 million barrels per day in 2022.

Before the pandemic, this situation was relatively easy since American shale producers were ready to pump as much oil as possible. Recently, however, most of them are comfortable with pumping less oil. They fear that boosting growth will expose them to significant challenges if the prices decline.

Therefore, there is a likelihood that the crude oil price will continue rising in the near term. Indeed, analysts at Mercuria, one of the biggest oil traders in the world expect prices to rise to $100. Putin also said that he expects that prices will rise to $100.

Crude oil price forecast

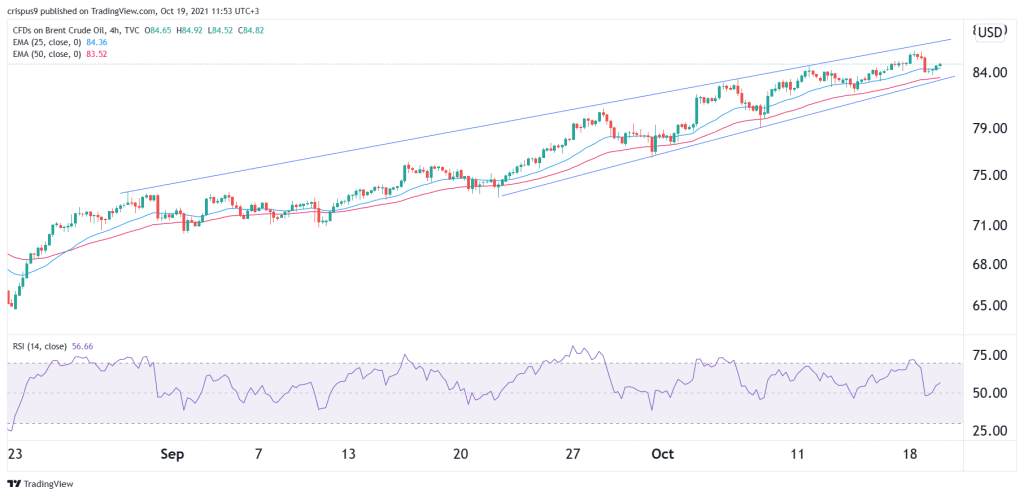

The four-hour chart shows that the crude oil price has been in a major bullish trend in the past few weeks as it soared to the highest level in 7 years. The bullish trend has been supported by the 25-day and 50-day moving averages. It has also formed an ascending triangle pattern that is shown in blue while the Relative Strength Index (RSI) has moved to the neutral level of 50.

Therefore, the price will likely maintain the bullish trend as the supply and demand imbalance continues. In the near term, the next key resistance to watch will be at $90. On the flip side, a move below $80 will invalidate this trend.