- The crude oil price has retreated sharply in the past few days as the spectacular recovery takes a breather. What next for Brent and WTI?

The crude oil price has retreated sharply in the past few days as the spectacular recovery takes a breather. West Texas Intermediate (WTI) dropped below $100 while Brent, the global benchmark has fallen to about $105. This means that oil prices have crashed by about 23% from the year-to-date high. Other commodity prices like natural gas, copper, and wheat have also dropped.

There are three main reasons why oil prices have retreated in the past few days. First, while shelling is continuing in Ukraine, there are signs that the two sides will reach an agreement in the coming months. For one, there are indications that the Russian military is struggling with low supplies. According to the White House, Putin has asked Xi for weapons supplies.

Second, crude oil prices declined after India was considering buying oil from Russia at a steep discount. However, China has also continued buying oil from the country, meaning that supply disruptions will be limited. Finally, the price has fallen as some buyers take profits. Historically, prices tend to decline sharply after hitting a key resistance level. Still, analysts at JP Morgan expect that prices will rise to $185. They wrote: “As sanctions have widened and the shift to energy security takes on an urgent priority, there will likely be ramifications for Russian oil sales into Europe and the US, potentially impacting up to 4.3 million barrels per day.”

Crude oil price forecast

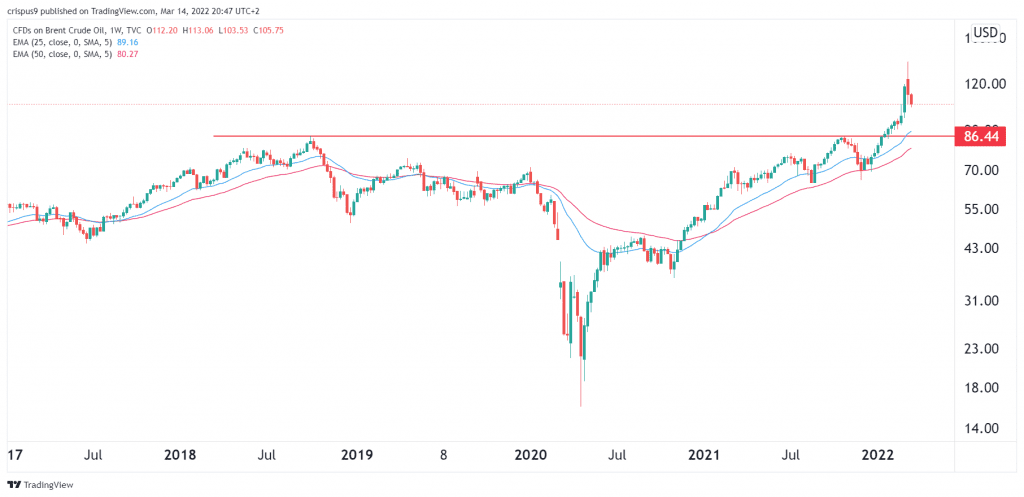

The weekly chart shows that the crude oil price is in the second consecutive weekly decline. A closer look shows that it remains above the key resistance level at $86.44, which was the highest level in October 2018. Also, the price has also formed an inverted head and shoulders pattern, which is usually a bullish view. Therefore, there is a likelihood that it will do a break and retest pattern and fall to $86.44, and then resume the bullish trend.