- Crude oil price has eased on its rallying. However, it is on track to recording the highest weekly gain since late August.

Crude oil price has pulled back from Thursday’s high, even as it remains on track to recording the highest weekly gain since late August. The rallying has eased concerns over the impact of the Omicron variant on global oil demand. However, the market is not out of the woods yet.

There are lingering concerns that the new COVID-19 variant may trigger restrictions across borders during the holiday season. Besides, the commodity may record subtle movements in the immediate term as investors lock in the attained profits after the week-long rallying.

Crude oil price prediction

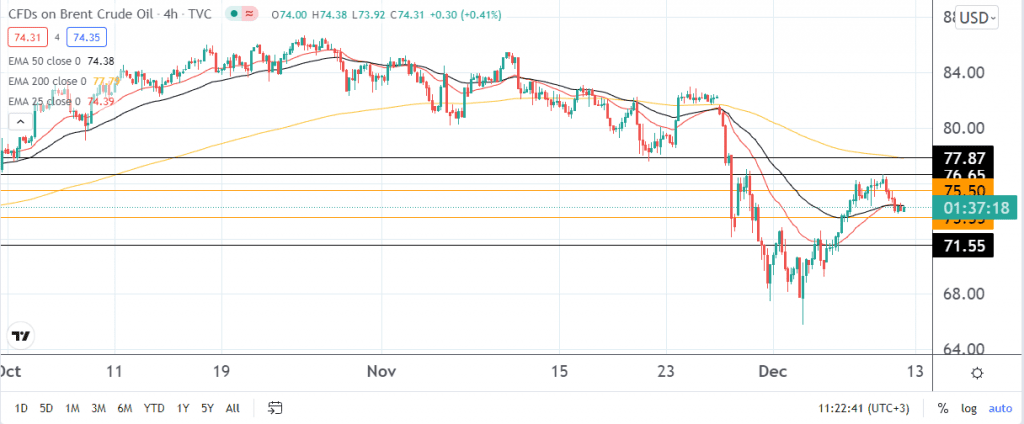

Brent futures have eased at around 74.00 after dropping from Thursday’s high of 76.65. Prior to the pullback, crude oil price was on a relief rally for six consecutive sessions after hitting a three-month low of 65.77.

At the time of writing, Brent oil was up by 0.46% at 74.34. On a four-hour chart, it is trading along the 25 and 50-day exponential moving averages, which have converged at 74.46.

In the near term, crude oil price will likely remain within the range of between 73.55 and 75.50. With further bullish momentum, it may break the resistance at 75.50 to retest the week’s high at 76.65 or higher along the 200-day EMA at 77.87. On the flip side, a move below the range’s lower border will probably place the support zone at 71.55.