- Crude oil price is hovering around $74.50 after bouncing off the week's low. In the ensuing sessions, investors will be keen on the global oil demand confidence.

Crude oil price is hovering around $74.50 amid rising demand confidence. Interestingly, the key agencies – OPEC, IEA, and EIA – have differing outlooks for the coming month.

To begin with, earlier in the week, OPEC raised its forecast for global oil demand in Q1’22 by 1.1 million bpd. It has further maintained its prediction that demand will reach 100 million bpd in Q3’22, which will place it at the pre-pandemic level. According to the alliance, the Omicron variant will have a mild impact on oil consumption.

In comparison, the International Energy Agency (IEA) is of the opinion that Omicron will dampen global oil demand. Granted, in its recent Oil Market Report, it noted that the impact would be temporary. Subsequently, it adjusted its projections for the current and coming year to a demand growth rate of 5.4 million bpd and 3.3 million bpd respectively.

At the same time, EIA forecasts that demand will rise by 3.4 million bpd in the coming year. In its latest Short-Term Energy Outlook (STEO), the agency made a downward adjustment of 420,000 bpd from November’s STEO. Amid the differing projections, investors will be keen on the Omicron-related trend and overall demand confidence.

Crude oil price prediction

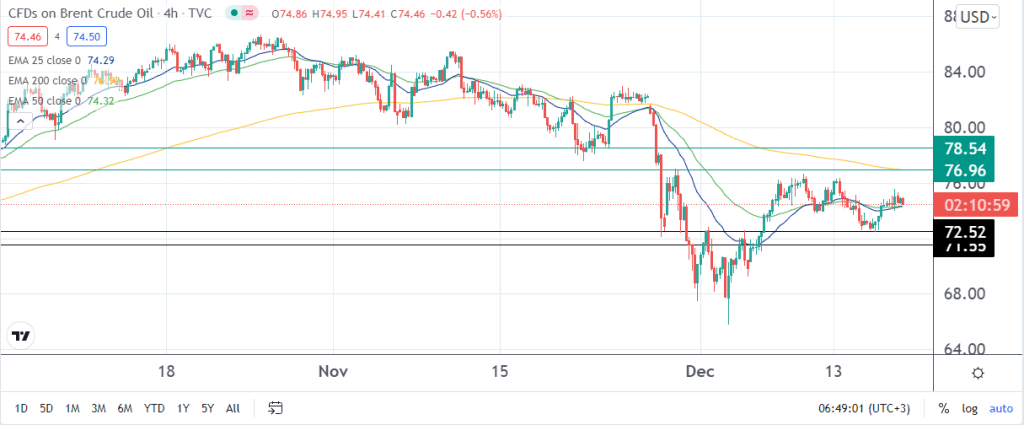

Brent futures have eased at around 74.50 after bouncing off the week’s low at 72.46. At the time of writing, crude oil price was down by 0.21% at 74.44.

On a four-hour chart, it is trading along the 25 and 50-day EMAs, which have converged at 74.40. While the outlook is rather neutral, I hold a bullish bias. It may rise further to find resistance along the 200-day EMA at 76.96. Above that mark, the zone to look out for will be 78.50. On the flip side, a move below the week’s low at 72.50 will likely place the support level at 71.55.