- Summary:

- The crude oil price is holding steady as the global demand rises and supplies remain under pressure. what next

The crude oil price is holding steady as the global demand rises and supplies remain under pressure. The price of Brent is slightly below $85 while the West Texas Intermediate (WTI) is slightly below $83.

Oil prices have done well this year as investors anticipate higher demand as the world economy reopens. For example, many countries are expected to reopen their airspaces this year because the Omicron variant is not as severe as what analysts were fearing.

At the same time, the ongoing underinvestment in oil production will likely lead to more supply challenges this year. Most companies like ExxonMobil and Chevron are expected to increase their production only marginally. The same is true with many shale producers, who are focusing on shareholder returns.

In a statement this week, Kyle Bass, the respected hedge fund manager, warned that the crude oil price will likely soar to over $100 this year. He cited the current trends in ESG as the main cause Bass is the billionaire founder of Hayman Capital. He said;

“I think you should buckle your seatbelts. You can’t just turn off hydrocarbons. It takes 40 or 50 years to switch fuel sources,”

Crude oil price prediction

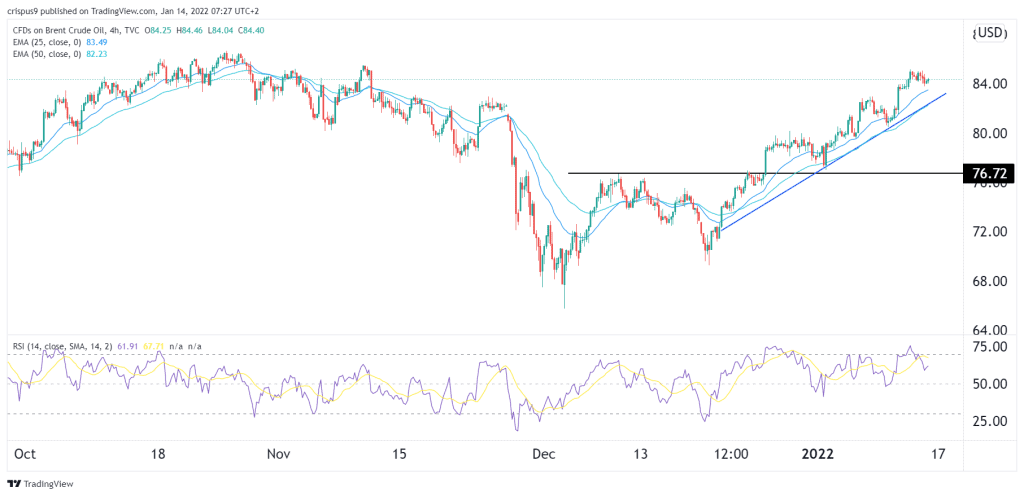

The four-hour chart shows that the crude oil prices have been in a strong bullish trend in the past few weeks. The price has remained above the 25-day and 50-day moving averages for a while. The rally gained steam when the prices moved above the key resistance at $76, which was the highest level on December 9th.

The crude oil price is also above the ascending trendline that is shown in blue. Therefore, there is a likelihood that the price will keep rising as bulls target last year’s high of almost $87. A move above that level will open the doors to the next key resistance at $90 followed by $100. This view will be invalidated if the price falls below $82.