- Summary:

- Crude oil price has dropped below the crucial support zone of $80. It will likely remain under pressure in the short term.

Crude oil price has declined below $80 amid heightened volatility in the market. The bull run that has existed since late August has been founded on a positive demand outlook and output cuts from OPEC. However, the alliance recently lowered its forecast for global oil demand in Q4’21. Besides, the new COVID-19 wave in Europe is poking hole into the bullish demand outlook.

On the supply side, IEA and OPEC expect supply surplus in coming months. Additionally, there are concerns that the US may release product from its Strategic Petroleum Reserve in an attempt to curb the soaring prices.

Crude oil price outlook

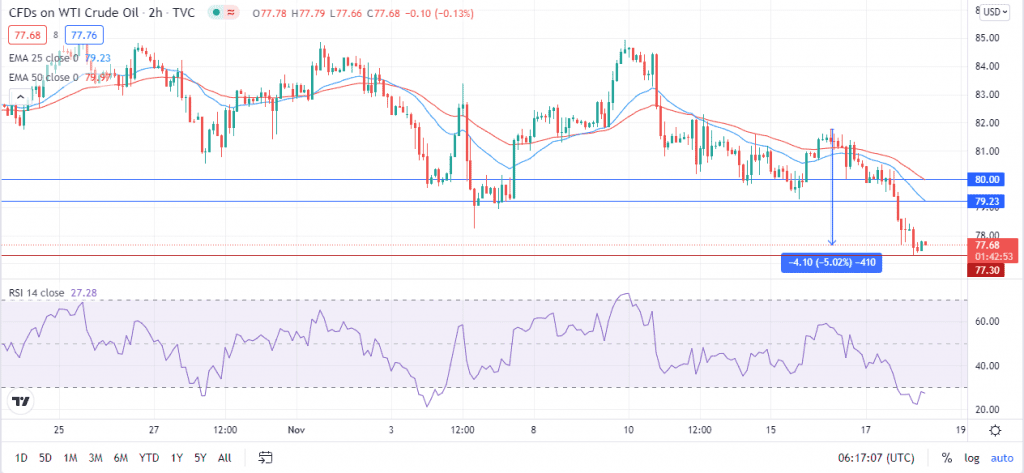

Since early October, 80 has been a steady and crucial support zone for crude oil price. In late October, the bull run boosted WTI futures to a 7-year high at 85.37. However, for about a week now, the bulls have had to defend the aforementioned support zone.

On Wednesday, the benchmark for US oil dropped below this level to Thursday’s one-month low of 77.30. Since Tuesday when it hit the week’s high at 81.79, the commodity has declined by about 5%.

On a two-hour chart, it is trading below the 25 and 50-day exponential moving averages. Besides, with an RSI of 27, it is in the oversold territory.

In the short term, I expect crude oil price to undergo a corrective rebound. It will likely experience resistance along the 25-day EMA at 79.23. Past this level, it may hover around the support-turn-resistance zone of 80. However, a move below Thursday’s low of 77.30 will invalidate this thesis.