- Summary:

- Saudi Arabia's decision to cut 1 million barrels of crude oil in February and March, as well as lower API US crude oil stocks support Brent crude.

Crude oil price on the Brent benchmark rose to its highest level since 24 February 2020 after Saudi Arabia announced it would voluntarily and unilaterally reduce its production output by 1 million barrels per day in February and March 2020. This announcement helped to temper concerns about a possible drop in demand due to rising coronavirus cases.

However, the API crude inventories data showed a larger-than-expected drop, sending prices to an intraday high of $57.40. Analysts at Commerzbank re-echoed the sentiment in the market, stating that positive signs on the demand and supply angles of the equation were providing support to oil prices.

The market awaits the EIA version of the crude oil inventories report, due later today at 1530 hours UTC.

Technical Levels to Watch

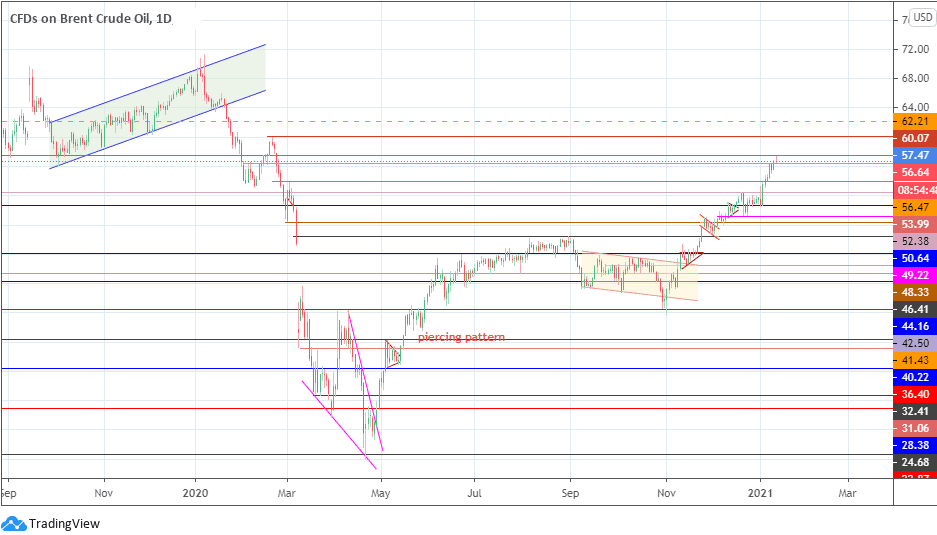

The resistance level to beat remains the 57.47 price level. If bulls can initiate a breakout above this level, then crude oil price on the Brent benchmark could be on its way to $60 a barrel. Above this price, the 25 October 2019 high at 62.21 becomes available as a new target.

On the flip side, rejection and a pullback at 57.47 allow sellers to target 56.47 as the initial support below the current price. A further dip in price targets 53.99, with 52.38 and 50.64 lining up as potential targets to the south.

Crude Oil Price (Brent); Daily Chart