- Summary:

- China's refinery output hits record highs, and this could fuel greater crude demand in 2021 and push crude oil prices to $60.

Hopes of improved demand in the second quarter of 2021 as well as risky sentiment in the markets are pushing crude oil prices higher on the day.

Despite the International Energy Agency’s cutback on its demand outlook, a record rise in China’s refinery output by 3% was cheered by the markets, as this indicates that China’s demand for the product is on the rise and could lead to a faster recovery of this sector.

A decline in the US Dollar, as well as optimism that the stimulus packages of the incoming US government would lead to faster global growth and crude oil demand recovery, led to a 2.28% spike in Brent crude price on Tuesday.

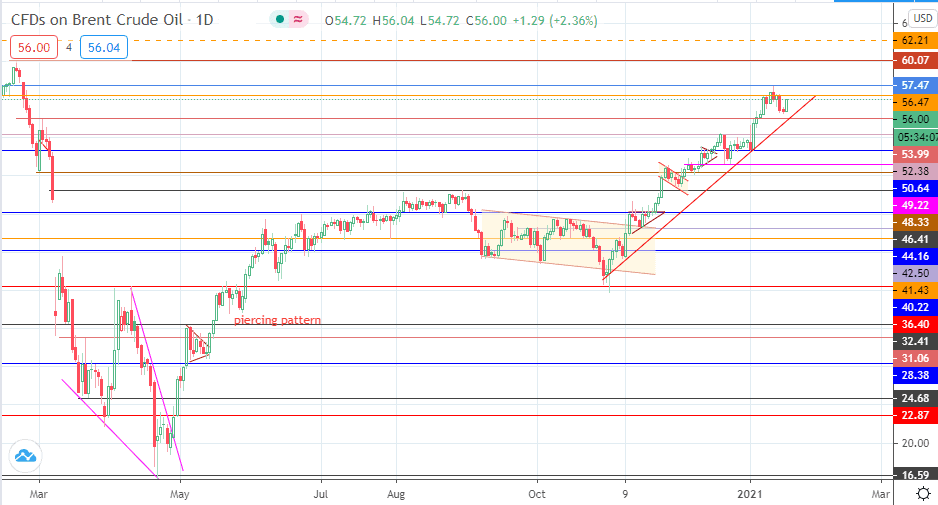

Technical Outlook for Brent Crude

Brent crude oil price outlook indicates that buyers would soon encounter resistance at 56.47. Price would need to break this barrier as well as the high of 13 January to resume the uptrend recovery in the short term, clearing a pathway towards 60.07.

On the flip side, a rejection at 56.47 forms an evolving double top on the daily chart, and the resulting pullback and breakdown of the 53.99 neckline would allow sellers to aim for 52.38, with 50.64 forming an additional target to the south.

Brent Crude; Daily Chart