- Summary:

- Crude oil trades lower today giving up about one dollar to 53,57 as the price retreats for recent high. The recent positive developments in the USA – Mexico

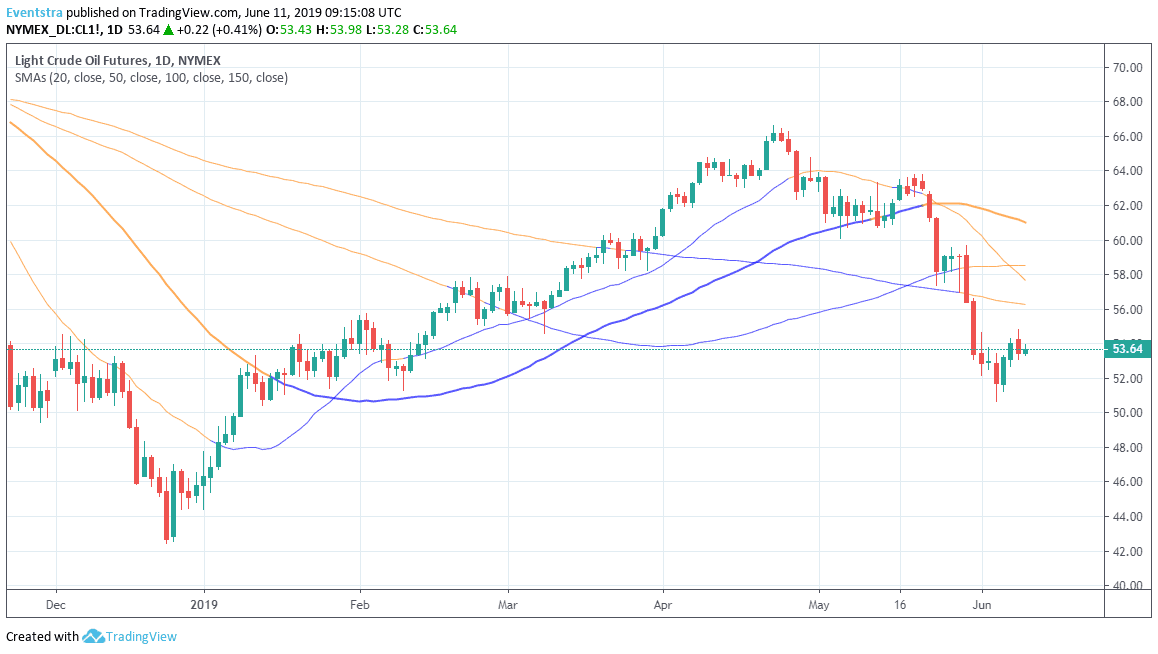

Crude oil trades lower today giving up about one dollar to 53,57 as the price retreats for recent high. The recent positive developments in the USA – Mexico conflict boosted a relief rally to oil benchmarks around the globe. The outlook for the crude oil market has darkened as IEA predicted a significant supply deficit in the 2Q of 2019 even as it acknowledged some cracks in demand. But since then things have seemingly taken a turn for the worse, with crude oil recording its worst month since the financial crisis. The previous week API report, showed that crude oil stocks in the USA grew by 3.5 million barrels in the week ending May 31, the EIA announced that commercial crude oil inventories rose by 6.8 million barrels in the same period compared to economist’s’ estimate for a draw of 0.8 million barrels. The Baker Hughes Energy Services showed that the total number of active oil rigs dropped to 789 from 800 last week and helped crude oil preserve its daily gains.

Black gold is in bearish momentum as the previous week has breached all the major daily moving averages and also today breached the 20 and 50 hour moving averages. Crude oil immediate support stands at 53.08 the 100 hour moving while more solid support stands at 50.50 the low from June 5th. On the upside first resistance stands at 150 day moving average at 56.33 while next resistance stands at 58.52 where the 100 day moving averages crosses.