- Summary:

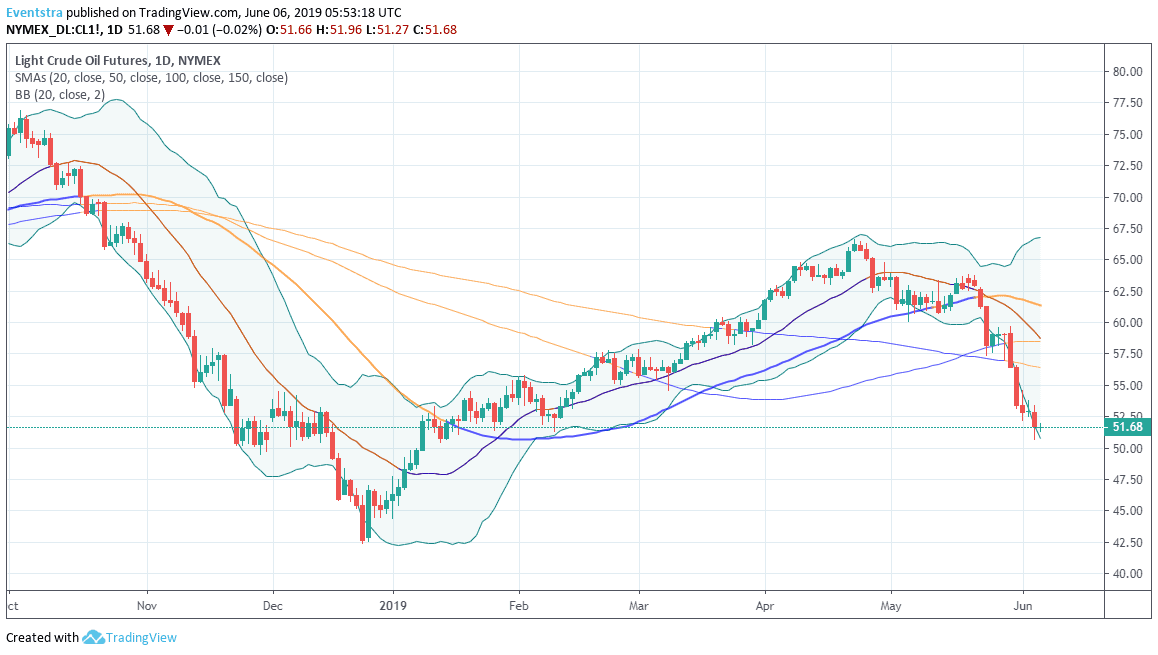

- Crude oil finished lower for one more day down to 51.73 losing $1.23 (-2.30%) a level that we haven’t seen since January 8th 2019.

Crude oil finished lower for one more day down to 51.73 losing $1.23 (-2.30%) a level that we haven’t seen since January 8th 2019. The recent US-China trade war escalation and threats that USA will impose tariffs to all Mexican imports pressing oil benchmarks around the globe. This week API report, showed that crude oil stocks in the USA grew by 3.5 million barrels in the week ending May 31, the EIA announced that commercial crude oil inventories rose by 6.8 million barrels in the same period compared to economist’s’ estimate for a draw of 0.8 million barrels.

Black gold is in bearish momentum as this week has breached all the major daily moving averages. Just to add to bearish bias the price of crude oil close for one more day below the lower Bollinger Band, confirming their strong downward momentum in the short-term. Crude oil immediate support stands at 50.50 the low from November 2018 while more solid support stands at 48.50. On the upside first resistance stands at 150 day moving average at 56.43 while a return back into the Bollinger Band could signal a potential change in short term momentum that might lead to a correction back up towards the center of the Bollinger Bands at 58.76.