- Summary:

- Credit Suisse predicts more downside for the EURUSD, but only if a certain resistance reference level stays intact and resists buying pressure.

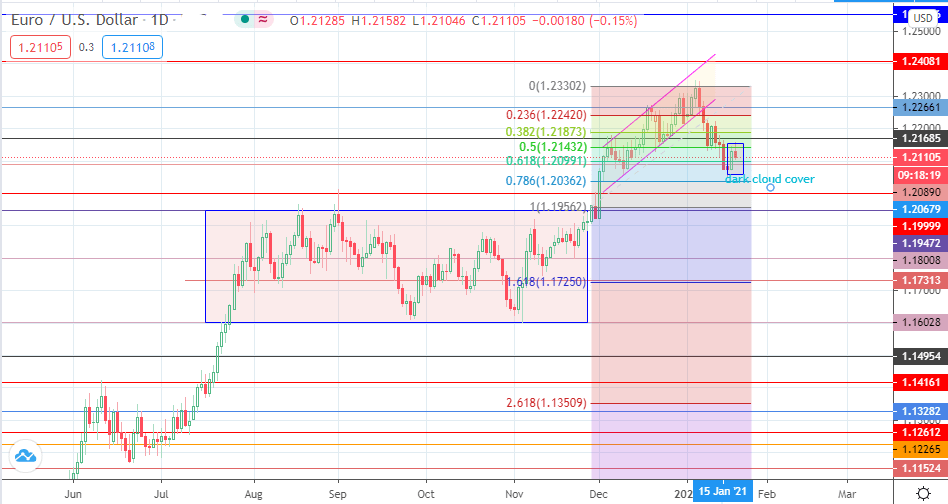

Despite the recovery of the EUR/USD in this week’s trading sessions, Credit Suisse expects the pair to resume the downside move if the resistance at 1.2231 stays intact. According to the bank, the 1.2223 price level is the upside barrier that has to give way for any further upside recovery to occur. .

Risk sentiment has risen generally, especially as incoming US Treasury Secretary Janet Yellen called on the US Congress to act big on the stimulus front to rescue the US and global economies. Her comments were generally bearish for the greenback, allowing the EURUSD to gain 0.45% on Tuesday. However, this upside move has met a brick wall at the 1.21432 resistance, formed by the 50% Fibonacci retracement level from the 27 November swing low to the 6 January swing high.

This move was noted by Credit Swiss, also noting that the move was capped at the 13-day average as a small ‘head & shoulders’ top is in place. The bank feels that the pattern suggests a risk of a correction before resumption of the broader uptrend. This correction could get to the price objective of 1.1924/1.1914, taking out a number of price levels. Bullish clearance of 1.2223/31is required to cancel out the top and end the correction 1.2350/55 highs.

Technical Levels to Watch

The daily chart shows a dark cloud cover pattern, which has been formed by Tuesday’s and Wednesday’s candles.

The 2nd candle needs to close below the 61.8% Fibonacci retracement at 1.20991, followed by an outside day candle with a bearish close, to confirm the downside break. However, the price needs to drop below the 18 January pinbar candle for 1.20362 (78.6% Fibonacci retracement level) to come into the picture.

On the other hand, a clear break of 1.21432 takes the pair towards 1.21873 (38.2% Fibonacci retracement), with 1.22661 and 1.24081 lining up as immediate targets to the north.

EURUSD Daily Chart