- Summary:

- Geopolitics and inflationary pressures are major headwinds that the Cranswick share price will be faced with in 2022.

The Cranswick share price is trading lower by 0.54% on a day that has been characterized by low-volume trading. The decline puts the stock on course to notching the sixth day of losses out of seven. The bearish sentiment that has beset the stock since hitting the 9 April high at 3768 has to do with the pressure on the retail sector, as inflationary pressures squeeze consumers and force new spending habits.

The UK meat producer continues to maintain its 2023 outlook, buoyed by higher annual profits resulting from cost-cutting measures. However, the decline in the Cranswick share price has stemmed from the company’s exposure to geopolitical factors.

The company has its roots in a Yorkshire pig farming cooperative, and the price of cereals, which constitute as much as two-thirds of the costs of rearing pigs, have increased more than 50% since the Ukraine conflict began. Ukraine and Russia collectively account for 21% of the world’s wheat supply.

Recall that some weeks ago, the head of the UK pig farmers association said its members were spending more than they were making in rearing their pigs and called on supermarket chains such as Tesco to pay more for products as a way to support the ailing industry.

Cranswick Share Price Forecast

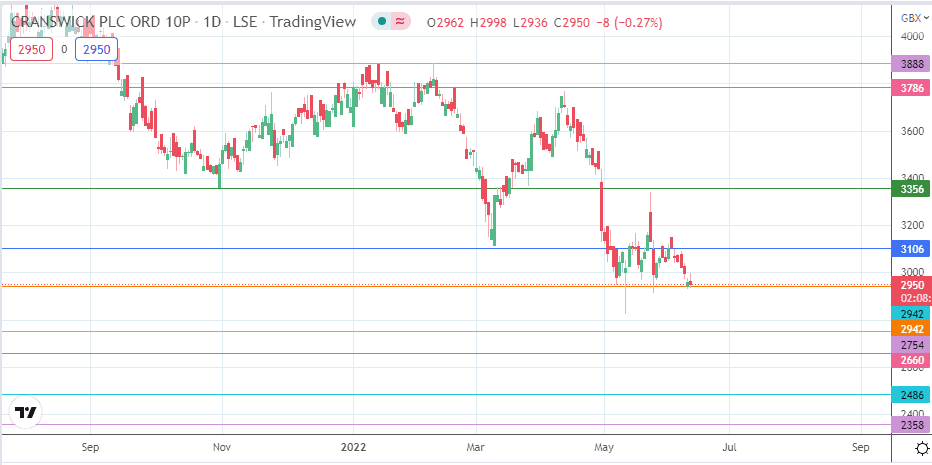

The intraday decline is testing the support at 2942. If the bulls find themselves overwhelmed by selling pressure, they may make a tactical retreat toward 2754, mounting opposition at that level to make it an initial target for the bears. Conversely, a breakdown of 2754 allows the bears to push toward 2660, where the prior lows are seen.

Below this level, additional price targets to the south are located at 2486 (triple bottom of 21 June 2019, 23 July 2019 and 16 August 2019) and at the 2358 price mark (16 March 2017 and 7 February 2019 lows). On the flip side, a bounce on the 2942 price support allows the bulls to aim for the 3106 resistance level (20 May 2022 and 1 June 2022 highs).

A further advance beyond this barrier sends the price action toward the 3356 resistance, formed by the 29 October 2021 and 19 March 2022 lows. There is a potential for the 3600 psychological price mark to form a potential pitstop to the advance from 3356. Additional northbound targets are found at 3786 (4 January and 18 February 2022 highs) and at 3888 (14 January and 9 February highs).

Cranswick: Daily Chart