- Summary:

- The Cosmos price prediction for 2022-2025 looks very promising, if the price picture on the charts plays out as expected.

Table of Contents

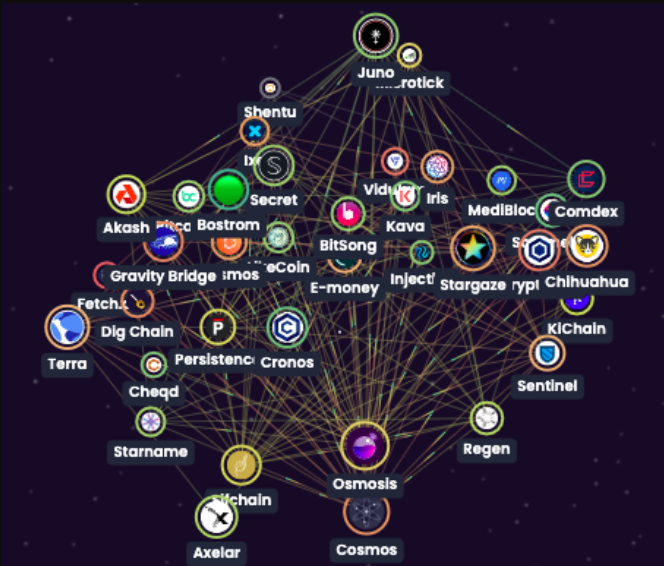

Cosmos is the first public Proof-of-Stake blockchain built on a Byzantine Fault Tolerant consensus algorithm. In 2019, the Cosmos Hub was launched. The Cosmos SDK is now being used by many blockchain projects combined to make the total value locked in Cosmos one of the highest in the industry.

The COSMOS Founders

The Cosmos blockchain was founded in 2016 by Jae Kwon and Ethan Buchman. The two co-founders were also the initiators of the Tendermint consensus algorithm.

COSMOS Road Map

The latest Cosmos Hub Product Roadmap was released in June 2021. The roadmap features the Delta and Vega upgrades, completed in July and December 2021.

Scheduled roadmap milestones for 2022 are:

- v7-Theta Upgrade, which is expected in the first quarter of 2022. This upgrade introduces Cosmos SDK v0.45 and Gaia v7.0.x. This is a minimal upgrade with limited fixes, including a circuit breaker governance proposal. This will block new liquidity from being added if there is an ongoing upgrade.

- v8-Rho Upgrade, which comes up in the second quarter of 2022. This introduces Cosmos SDK v0.46 and Gaia v8.0.x, enabling higher-level multisig permissioned accounts. Meta transactions will be enabled, and execution of arbitrary transactions and not just governance proposals. This upgrade also introduces Tendermint v0.35 and the much anticipated NFT module.

- v9-Lambda Upgrade, scheduled for completion in Q3 2022. This upgrade introduces Gaia v.90.x and Interchain Security v1, which requires the participation of provider chain validators. This upgrade also introduces a chain name service that requires chain ID and node registry, asset and account registries, and a Bech32 registry.

- v10- Epilson, due to be completed in Q4 2022. This is the Gaia v10.0x and also features Interchain Security v2. Cosmos SDK v0.47 will also come with this upgrade.

Future considerations include a v11-Gamma upgrade expected in Q1 2023 and improvements to privacy, smart contract structure, and rollups. The Gamma upgrade will allow consumer chains to combine the provider’s chain validator set with their own staking validator sets.

COSMOS’s Adoption Statistics

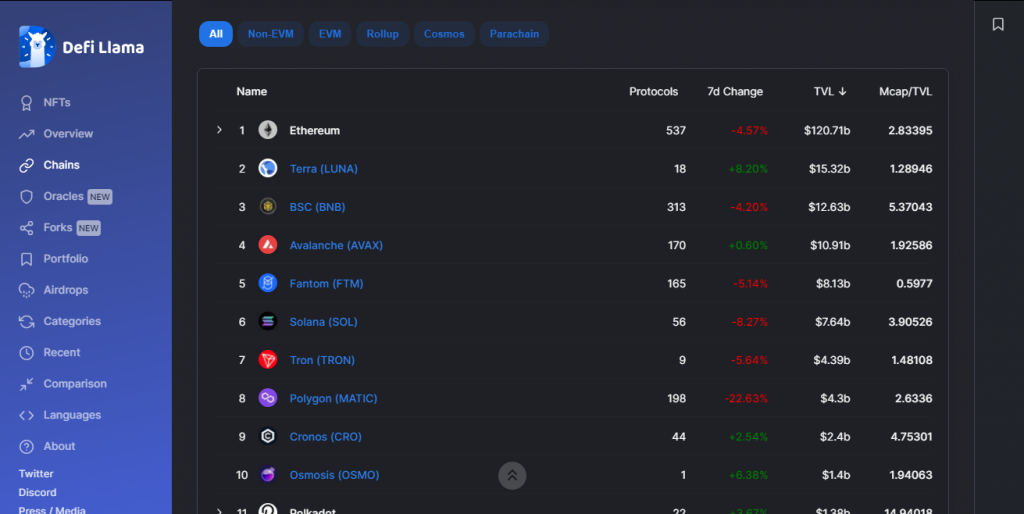

The latest Cosmos news as far as adoption is concerned indicates that the ecosystem has surged to a total value locked (TVL) of $17billion, as it continues to mount a challenge to Ethereum in the battle of Layer-2 networks. Of all the blockchains that have been built using the software development kit (SDK) of Cosmos, Terra is tops. It is also number 2 in terms of TVL rankings by Defi Llama, with a TVL of $15.32 billion. Other projects that make up the TVL of Cosmos include Osmosis ($1.4 billion), KAVA ($588m), Thorchain and Sifchain.

Cosmos SDK is used in various chains, and all are connected via the Inter-Blockchain Protocol. Therefore, the potential for the TVL to exceed the current value remains very high.

COSMOS Price Prediction 2022

The Cosmos price prediction 2022 outlook appears to be heading towards the bullish end of the price spectrum. This is because of the emerging ascending triangle pattern on the weekly chart. The progressively higher lows gradually push against the primary barrier at 32.21, coming off a bounce on the 25.84 support. A break of 32.21 leaves 44.95 as the only barrier between the bulls and new all-time highs. There is a potential for the pattern to resolve at the bullish end of this year.

However, this Cosmos price prediction 2022 outlook is negated if the price declines below 25.84. This move breaks down the triangle’s lower border and opens the door towards 20.34 and 16.03 as medium-term targets. 9.84 is the lowest the price has fallen to in the last eight months. It will come into the horizon if this decline plays out.

COSMOS Price Prediction 2025

The monthly chart presents the long-term outlook for COSMOS over several years. The chart shows that the trend for COSMOS remains bullish, and the downside seen between November 2021 and January 2022 is a correction within the long-term uptrend. The active monthly candle gradually forms a pin bar that sits on the 25.84 support.

The Cosmos price prediction for 2025 follows the outlook for 2022. Cosmos is expected to initiate a strong bounce from the 25.84 support mark, which takes it to the 32.21 resistance level. As a result, there is a solid chance of Cosmos staying above the $40 mark by 2025. The Cosmos price prediction 2025 outlook improves if the bulls send the token above the 44.95 price mark to set a new high. With the various upgrades lined up by the Cosmos team, the future for the ATOM token looks bright.

Only if the token breaks down 25.84 and the 20.34 price mark (61.8% Fibonacci retracement from the 1 December 2020 swing low to the 1 January 2022 swing high on the monthly chart) will the outlook be downgraded.

Is COSMOS a Good Investment?

Cosmos has the potential to be an excellent investment. The price picture is looking very favourable, but the upgrades and milestones in the roadmap point to a project that is abreast with the yearnings of the blockchain community.

Cosmos has positioned itself properly in the areas of DeFi and is looking to make a bold entry into NFTs. The project looks destined to increase its total value locked, and with an ecosystem primed as the next generation blockchain (Blockchain 3.0), the future looks bright for Cosmos.

Cosmos is a good investment for the medium term and long term, especially with price now sitting on an outstanding support level from which a price increase looks imminent.

How to Buy COSMOS?

The ATOM token is available for purchase from several cryptocurrency exchanges. It can be purchased using the US Dollar, Tether or Bitcoin in various pairings. The best way to buy ATOM in volatile markets is to purchase using limit orders to avoid slippage and paying extra fees on the crypto exchange. Otherwise, market orders would work just fine in non-volatile market conditions.

ATOM/USD: Weekly Chart

Follow Eno on Twitter.