- Summary:

- Copper price recovery stalled this week after the worrying economic data from China. The metal was trading at $3.6 on Wednesday morning

Copper price recovery stalled this week after the worrying economic data from China. The metal was trading at $3.6 on Wednesday morning, which was slightly lower than this month’s high of $3.71. The price is about 15% below the lowest level this year.

Copper challenges remain

Copper price has come under intense pressure recently because of the ongoing happenings in China. Data published on Monday revealed that the country’s economic growth is stalling. Retail sales, fixed asset investments, and industrial production rose at a slower pace than expected in July. At the same time, about 1 in 5 young people in the country are unemployed.

Most of these issues are primarily because of the country’s Covid-zero strategy. And recently, the number of new Covid cases has jumped sharply. Meanwhile, the housing market in China is going through major challenges as liquidity dries. As a result, many companies in the sector, including Evergrande, are under intense strain as people stop paying their mortgage rates.

Copper price has also pulled back because of financing challenges. This month, it was revealed that a group of copper traders found that metal worth over $500 million was missing. As such, there is a likelihood that many trade finance banks will slow down lending to the sector. In addition, analysts believe that similar and unreported situations have been rising.

Still, long-term demand for copper is expected to surge as countries upgrade their power grid. According to Bloomberg, annual copper demand is set to soar by 53% by 2040. As a result, there will be a supply shortfall of over 40 million metric tons.

Copper price prediction

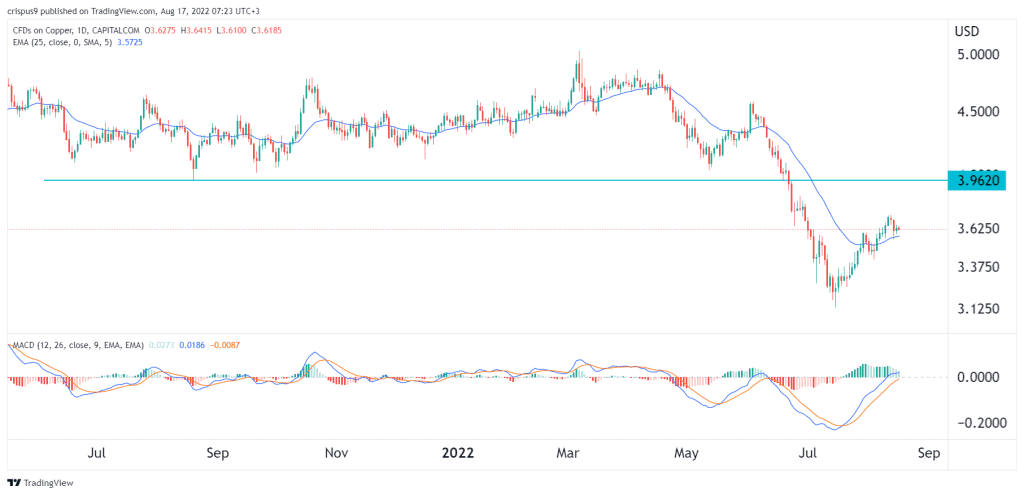

The daily chart shows that copper price has been in a recovery mode after crashing to a low of $3.13 in July of this year. It has now bounced back to $3.62, which is about 15% above the lowest level this year. In addition, it has managed to move above the 25-day moving average while the MACD has moved slightly above the neutral level.

Therefore, the price of copper will likely continue rising as bulls target the next key resistance level at $3.96. This important price was the lowest point in August last year. It is also about 10% above the current level and is in line with my previous copper outlook. A move below the support at $3.50 will invalidate the bullish view.