- Summary:

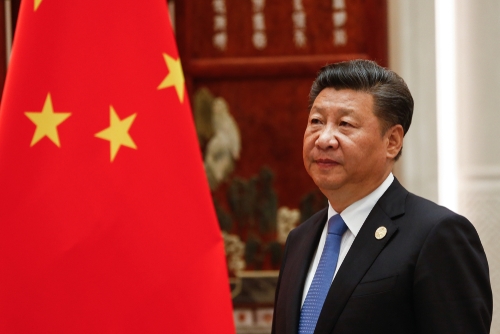

- Copper price continues on the downward trajectory as the coronavirus infection shows no signs of slowing down. Copper futures are lower.

Copper price took an Antipodean plunge today as the Coronavirus epidemic continues to spread at an alarming rate. New cases are cropping up in new countries and case counts in countries where the infection hit last week are rising steadily despite attempts to contain the contagion.

Copper is a raw material used in many industries and China, the epicentre of the recent epidemic happens to be the world’s largest importer of this product. Copper is now trading at 2.61629 after it started the week bearish, extending last week’s steep losses.

Read our Best Trading Ideas for 2020.

Technical Outlook for Copper

Copper (XCUUSD) has continued on its steep decline after last week’s weekly candle quickly attained the 3% downside penetration close below the channel’s trendline on the weekly chart. The immediate downside target lies at the 2.53518 price level, where lows of 6 March/12 June 2017, as well as 13 August/31 December 2018, were seen. This area was also tested on 5 August and 7 October 2019 but remained intact at that time.

A break below this area opens the door towards the April/July 2016 highs, which are expected to act in a role reversal as new support levels for continued downside moves on XCUUSD. On the flip side, any recovery on copper must first break the channel’s broken trendline, traverse the channel itself and push above the channel’s return line to target 2.83011 (multi-year highs of July/September 2018 as well as 23 December 2019/13 January 2020). 2.94741 lies above as further resistance. However, the sentiment is decidedly bearish and selling on rallies may be the market focus for now.