Brent crude forecasts for 2026 look set to go on a wild ride after the US actions in Venezuela in the New Year, which have thrown geopolitics to the front burner of price drivers for the year. Brent crude spiked as did gold prices after the US military captured erstwhile Venezuelan President Nicolas Maduro, with US President Trump declaring that the US would run the country and sell Venezuela’s oil to other countries.

For oil traders, the concern is how the scenario affects oil prices, as this has reshaped Brent crude price predictions for 2026. So what are these Brent oil price forecasts, and what will shape the Brent crude outlook in 2026?

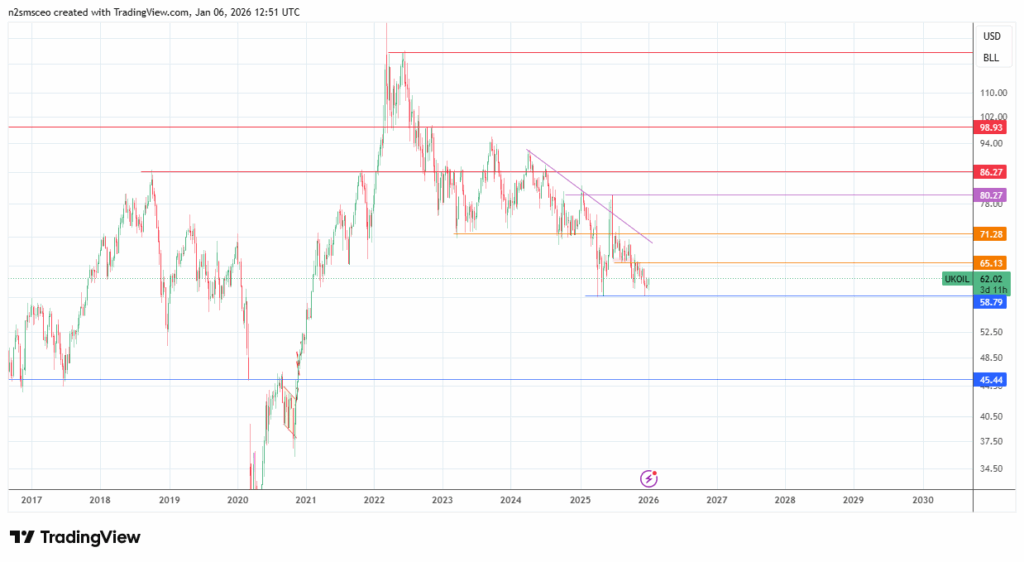

Brent Crude Live Chart

Brent crude oil price today continues to hover around $62 at the time of writing. The long-term chart below shows that the asset remains in a downtrend, which was brought on by declining demand from China amid the US tariffs. The market continues to struggle under conditions of robust supply and weak demand.

The latest spike in prices comes as a bounce off the 58.79 lows, triggered by the knee-jerk market response to the US military action in Venezuela.

Brent Crude forecasts 2026: Fundamental Drivers

The fundamental drivers for Brent crude forecasts include the following:

- Oversupply scenario

- OPEC policy

- Demand dynamics (China, global growth)

- Geopolitics

- Resilience of non-OPEC supply

How do these fundamental drivers impact oil prices?

1. Oversupply Scenario

The oversupply narrative remains the base case scenario for Brent crude forecasts in 2026. A Reuters survey of several economists suggests the crude oil market will remain oversupplied in 2026. These analysts estimate that a market surplus of 0.5-3.5 million barrels per day currently exists, which will keep prices hovering around $61.20 per barrel in 2026.

According to the US Energy Information Administration, this oversupply will be fed by a global rise in crude inventories in 2026, leading to a $55-per-barrel price forecast.

2. OPEC Policy (production quota adjustments)

The Organization of Petroleum Exporting Countries (OPEC) continues to maintain a demand growth projection for 2026 at this time. OPEC’s decision to start lifting production curbs has already been priced into the oversupply narrative. OPEC drivers will focus more on whether there are calls to reintroduce curbs or whether members are cheating on quotas.

The US action in Venezuela introduces a new dimension to the quota discussion. Will this force OPEC to take drastic action if there is a massive oversupply from the promised US oil flood? Will Trump force OPEC’s hand directly? It remains to be seen.

3. Demand Dynamics

China is the world’s largest crude oil buyer, followed by India. Demand from both nations provides support for Brent crude prices. But a slowing of the growth cycle, a drop in consumption, and a decline in industrial production feed into the current bearish narrative for Brent crude.

4. Geopolitics

Geopolitics has become a firm driver of oil prices, and nothing could provide more credence to this than the response of crude oil prices to the Israeli strikes on Iran in 2025 and the recent US military action in Venezuela. Middle East geopolitical risks and the situation around Venezuelan oil will continue to act as catalysts in 2026.

5. Non-OPEC Supply Resilience

Non-OPEC supply is dominated by Russian oil. Goldman Sachs indicates that a decline in Russian oil supply risks pushing Brent crude above $70, while resilience in this supply could send Brent crude into the $40s in 2026/2027.

Brent Crude Forecasts 2026

Three institutions have provided the current Brent crude forecasts for 2026.

Goldman Sachs’ Brent crude price projections have been mentioned. The projection is for Brent crude prices to decline into the $40s, driven by non-OPEC supply. If Russian supply drops off, a >$70 price target will be on the cards.

The EIA’s projection is for Brent crude to average $55 per barrel in 2026, while a Reuters poll of 34 economists reveals a consensus price of $61.27 per barrel in 2026.

- Base case: rising inventories -> Brent crude price of mid $50s to low $60s.

- Bull case: Tighter physical market from OPEC cuts, Russian supply decline and stronger demand/growth cycle. Price stays above $70

- Bear case: Oversupply (non-OPEC resilience, weaker demand/growth cycles, OPEC or US keep flooding markets. Brent crude shifts towards the $40s.

Technical Outlook

The weekly chart below shows significant support and resistance levels based on a multi-year view. The bearish trend, as indicated by the lower highs and lower lows from the 2024 price peak, is clear, and the price continues to respect the descending trendline resistance. The 2022 spike and subsequent pullback entered a consolidation, with downside resolution in 2026.

The 58.79 price mark (March, May, and December 2025 lows) remains the significant support to beat. Price is currently located just above this point. A breakdown of this support leaves the price to cascade lower, aiming to find support at 45.44 (coinciding with Goldman Sachs’ projections). This outlook would align with the overall bearish sentiment.

On the other hand, 65.13 remains the initial ceiling that any price bounce will contend with. Only when this barrier is uncapped can we see a push towards 71.28 initially (March 2023 and Q4 2024 lows), then towards 80.27 (June 2025 high), and finally towards 86.27 (October 2018 and October 2021 highs). This scenario would invalidate the bearish trend and confirm a bullish reversal.

FAQ

What is crude oil price today?

Brent crude futures are currently trading at $62 as of writing.

What are the Brent crude forecasts for 2026?

The Brent crude forecasts for 2026 see a base case of Brent price staying between mid $50s and low $60s. Bear and bull case price scenarios see Brent crude trading within the $40s and above $70, respectively.