- Summary:

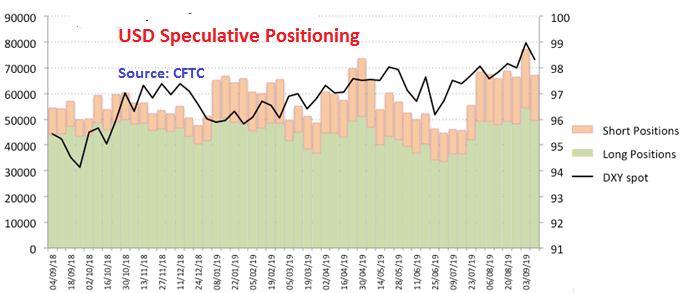

- The Commitment of Traders report shows an increase in net USD longs as traders price in a 25bps rate cut by the Fed on Wednesday,

The Commitment of Traders Report, otherwise known as the CFTC Positioning Report for the week ended September 10 has been released. It shows that the net long positions on the US Dollar have edged to its highest levels in 6 months, right before the US Fed meeting and subsequent rate decision on September 18.

Here are the highlights from the Commitment of Traders Report:

- It would appear that traders have fully priced in another 25bps cut by the Fed on September 18, and this is manifesting in the increase in USD net longs to 6-month highs. Why? The data that measure economic activity around manufacturing and services sectors have been positive, which puts the US on a better fundamental pedestal than other major economies, some of which are already well into their easing cycles.

- There was a decrease in net short positions on the Aussie Dollar, sending the net shorts level to 2-month lows. This is as a result of a general improvement in the vibes emanating from the US and China. Recall that President Trump of the US delayed the implementation of a new round of tariffs on $250billion worth of Chinese goods last week.

- Net shorts on the Euro are up after the ECB announced a new round of stimulus as well as a 10 bps rate cut.

- Brexit-related uncertainties which have created deep divisions among the major actors in UK politics has dampened sentiment on the British Pound, culminating in an increase in net short positions on the GBP, albeit at levels that are still below the record breaking lows of August.

- A combined increase in JPY longs and reduction in CHF shorts was noticed as safe haven demand was noticed in the markets in the period under review.

- A dovish Bank of Canada at its last monetary policy meeting sent net longs on the CAD soaring.