- Summary:

- The Coinbase stock price prediction indicates the potential for a short-term rally, which will precede a further correction.

The Coinbase stock price predictions have not changed dramatically, despite the recent uptick that occurred from the all-time low. The price action has stretched into a consolidation phase, which forms a rectangle pattern that still has bearish connotations. The shares of Coinbase global recently tested new lows after Atlantic Equities downgraded the stock from overweight to neutral. Atlantic also cut the Coinbase stock price target from $95 to $54.

The downgrade of the Coinbase Global stock is hardly surprising. The crypto winter has dealt a hefty blow to the stock that was launched to much fanfare during 2021’s crypto boom period. Since the listing day high of just under $495, the stock has plummeted to just a tenth of that value. This drop also coincides with the 90% to 95% drop in many altcoins from their 2021 highs as big bearish sentiment hit the market.

New Coinbase stock price predictions may arise when the stock faces yet another test: how the listed tokens on its platform respond to the Fed’s 28 July interest rate decision. The US apex bank is highly favoured to raise rates again, a bearish event on the risk-sensitive Nasdaq 100 index where Coinbase finds its home. For now, the consolidation means traders are waiting to see the new direction the price action will take. Coinbase is trading lower by 3.15% in premarket trading.

Coinbase Stock Price Prediction

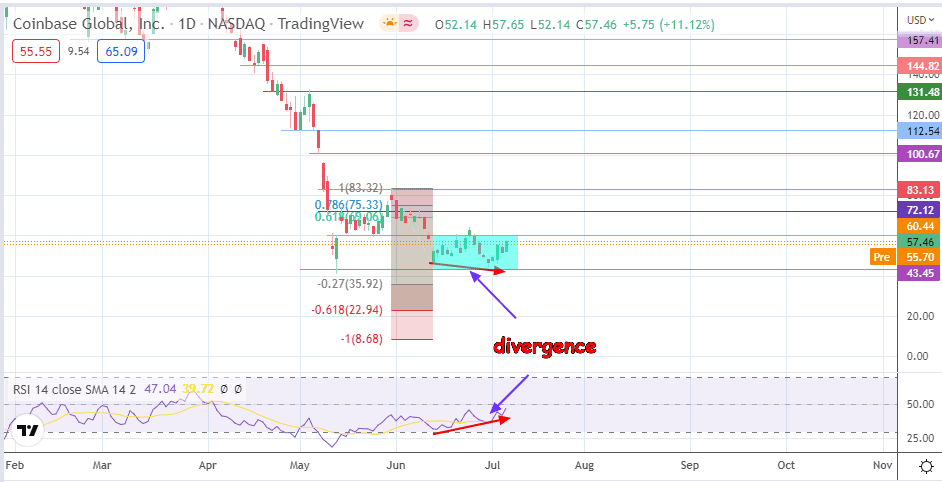

The regular bullish divergence of the RSI indicator from the price action indicates the potential for a further advance. The bulls must initiate a break of the 60.44 price resistance, site of the recent lows of 16 May and 25 May 2022, to confirm this signal. This break gives the bulls clear skies to aim for the 83.13 resistance.

Before this mark is attained, the 72.12 barrier that connects the highs of 18 May and 8 June is a potential pitstop. Additional targets to the north are seen at 83.13 and 100.67, the site of the 31 May high and 6 May low, respectively. Attainment of the latter covers the downside gap of 9 May.

On the flip side, the bears need a decline below the recent price floor at 43.45 (30 June low) to force a retreat that targets a new low at the 0.27 Fibonacci extension level at 35.92. Additional barriers to the south are found at the 22.95 price mark (61.8% Fibo extension) and at 8.68.

COIN: Daily Chart