- The Coinbase stock price prediction indicates a high potential for the stock to drop into record-low territory.

As US traders await the start of Thursday’s trading session, the latest Coinbase stock price predictions do not look very favourable. Coinbase is trading just shy of its all-time lows as the crypto exchange’s stock gets hammered with every downturn in the crypto market.

EU lawmakers have been seeking to ensure that Russian entities do not use the crypto market to evade sanctions. They may have got their wish as the Binance exchange has limited trading for Russian citizens with more than ten thousand euros in their trading accounts. This action by Binance announced on Thursday morning puts other crypto exchanges under pressure to implement the same. This could further dampen sentiment and create price deterioration for the Coinbase stock.

However, there could be hope for those holding Coinbase stock, as the exchange has launched a beta version of its marketplace for non-fungible tokens. In addition, the company will not charge any transaction fees for beta testers, who will also be able to buy or sell NFTs using any self-custody wallet. Whether this will translate into more favourable Coinbase stock price predictions remains to be seen when Thursday’s trading session opens.

Coinbase Stock Price Prediction

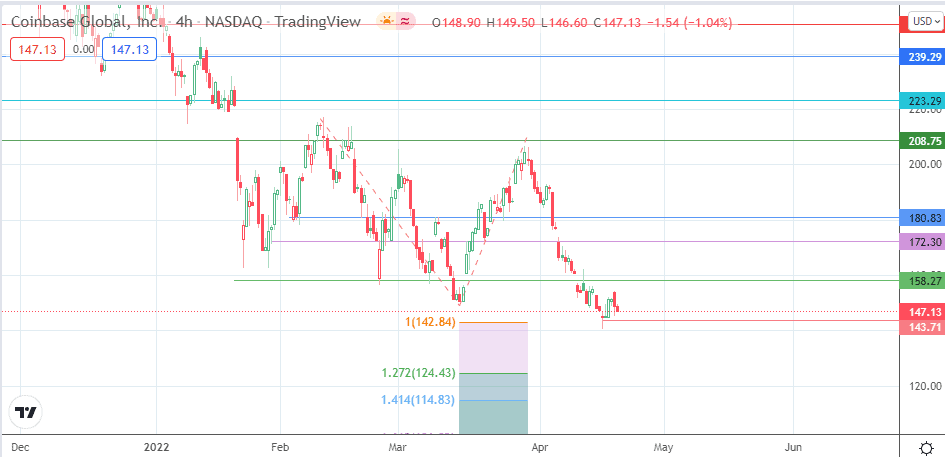

The 4-hour chart reveals that the 19 April low at 144.94 is the last bus stop before prices plunge into record low territory. Therefore, the 100% Fibonacci extension level from the price swings of 10 February to 14 March at 142.84 could be the initial target in the record-low zone. On the other hand, if the price drop continues below this point, the 124.43 price level (127.2% Fibonacci extension) and the 141.4% Fibo extension point at 114.83 may become the new targets to the south.

On the flip side, a bounce on the current record low at 140.60 or the 19 April low at 144.94 could enable the bulls to target 157.12 (11 April high). Above this level, 172.30 and 180.33 (9 March high) could become new targets to the north. There is also the possibility of these points serving as potential rally-sell areas. An advance towards 208.75 makes this notion more unlikely.

Coinbase: 4-hour Chart