- Summary:

- With the break of the immediate resistance, the Clover Health share price could see a clearer path to recovery.

The Clover Health share price continues to see recovery as investors bask in the optimism provided by the company’s latest quarterly results. On 9 May, Clover Health announced total revenue of $874.4 million and -$74.8million in EBITDA. These numbers topped the forecasts of Wall Street analysts, who had predicted revenue of $787m and EBITDA of -$105.3 million.

The company also reaffirmed its earlier positive guidance for the full year. It expects to pull in $3.0 -$3.4 billion in revenue along with a boost in insurance membership to 84,000 – 85,000, which more or less keeps the membership slightly above current levels. Investors have shown faith with the cautious optimism and improvement in earnings, resulting in a bounce from the 1.99 price level to the 2.74 price mark as of writing.

The Clover Health share price will still need to do more to break beyond the 3.00 mark, which the stock last touched on 21 April. The three-day uptick has enabled the stock to form a doji candle on the weekly chart, sitting on the 2.68 support. Will this propel the Clover Health share price higher?

Clover Health Share Price Forecast

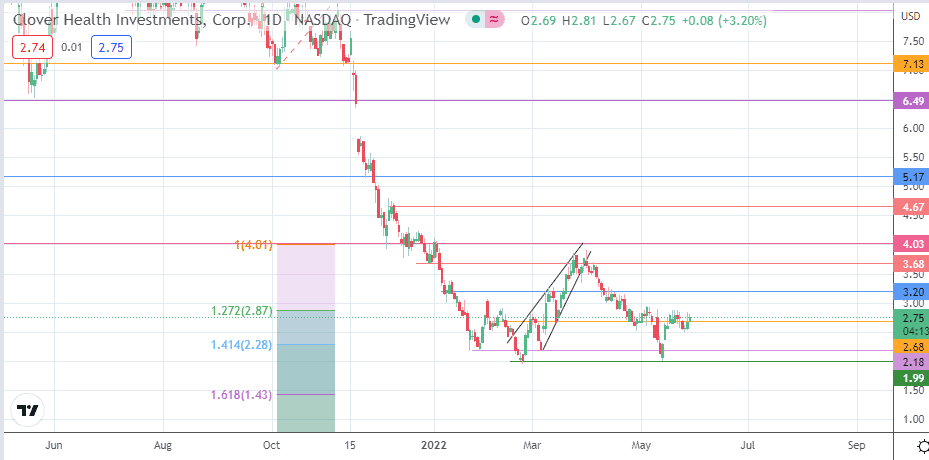

After completing the measured move from the rising wedge’s breakdown and subsequent bounce on the 1.99 support, the price activity has cleared the 2.68 resistance. This move will open the door toward 3.20, where prior highs were seen on 9 March and 14 April 2022. A further advance targets 3.68 (30 December 2021 low and 4 April 2022 high). Clearance of the 3.68 resistance gives the bulls access to the 4.03 barrier, the site of a previous high seen on 3 January 2022.

Conversely, a decline below the 2.68 price mark preserves that spot as a resistance. Failure to clear this price level on subsequent retests can produce a pullback move aiming for the 1.99 support level. Before 1.99 becomes available, the 2.18 support formed by the prior lows of 28 January and 4 March 2022 could constitute an obstacle. We shall see new record lows only when 2.18 and 1.99 are degraded, with the 161.8 Fibonacci extension level at 1.43 becoming a likely candidate for further support.

CLOV: Daily Chart