- Summary:

- EasyJet share price has crawled back in the past few weeks even after the company reported a big loss for the first half of the year.

EasyJet share price has crawled back in the past few weeks, even after the company reported a big loss for the year’s first half. EZJ stock rose to a high of 407p, which was about 20% above the lowest level this year. However, the price is about 55% below the highest level in 2021.

Is EZJ a good buy?

EasyJet is a leading low-cost regional airline that operates on many routes in Europe. The company has a market cap of over 3 billion pounds, making it one of the top firms in the FTSE 250 index.

The firm’s stock has done relatively well in the past few days as investors price in more demand for its services. Notably, demand is rising at a time when crude oil prices are retreating. In addition, jet fuel has been on a downward trend in the past few months.

Analysts are generally bullish on the EasyJet share price. For example, this month, those at UBS Group and Goldman Sachs set their target at 805p and 606p, respectively. These prices imply a significant upside, with the UBS target being almost double the current price.

Other analysts who are bullish on the EasyJet share price are from Berenberg, Deutsche Bank, Bernstein, and HSBC, among others. All these analysts expect that the company’s shares will rise above 500p in the near term. Their view is that demand remains healthy while the cost of doing business will drop slightly because of the cost of fuel.

EasyJet share price forecast

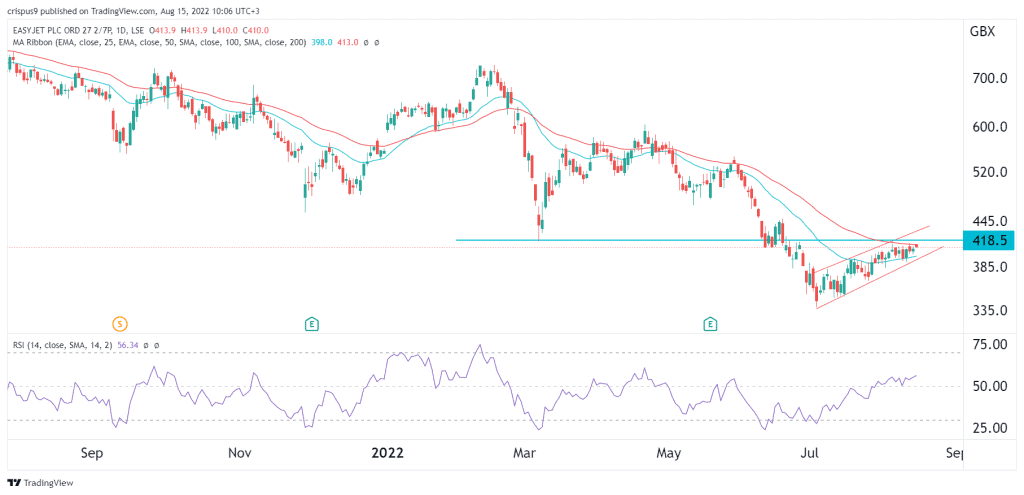

The daily chart shows that the EZJ stock price has been in a recovery mode after it published its half-year results recently. In this period, the shares have managed to move from a low of 337p to 412p. In addition, it has managed to retest the important support level on March 7, which was the lowest level on March 7.

Along the way, the shares have moved above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved above 50. Therefore, the stock is at a delicate level. A move above the resistance point at 420p will signal that bulls have prevailed. On the other hand, this recovery could be part of a break and retest pattern, which is usually a bearish sign.