- Summary:

- The Cineworld share price remains range bound as the case between it and Cineplex over the failed takeover bid continues.

The Cineworld share price is trading within a range, despite a 1.62% drop on the day. Wednesday’s slide follows three days of gains that have not done much to build bullish stock momentum. This comes as a legal dispute between the UK theatre giant and Cineplex Inc rages.

Canadian company Cineplex is accusing Cineworld of deliberately delaying a planned takeover deal as the pandemic took hold. Cineplex is claiming $2.18 billion in damages for the failed deal. Both parties had agreed to a takeover deal in December 2019, but Cineworld decided not to go ahead with the agreement when the coronavirus-induced lockdowns took hold in 2020.

Cineworld is defending its actions, saying that Cineplex’s decision to delay accounts payable by 60 days was a breach of the deal’s original terms. It said it had a right to cancel under these circumstances.

Cineworld Share Price Outlook

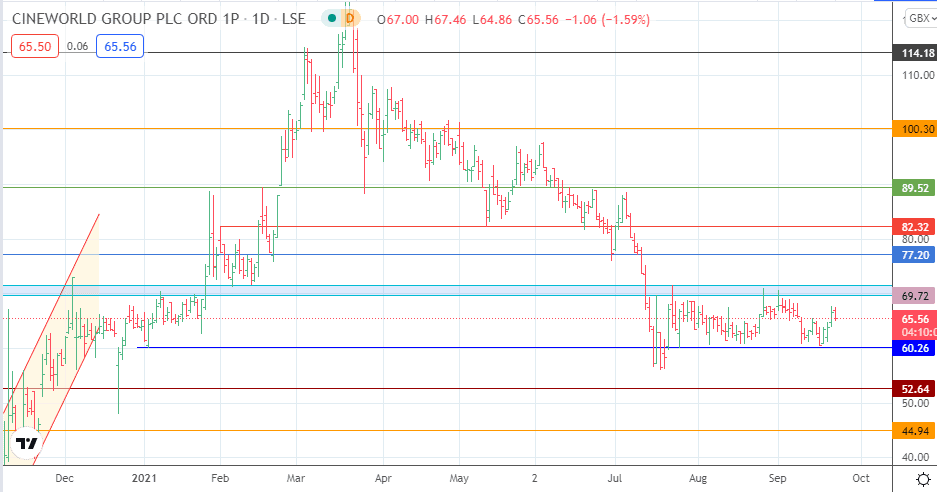

The Cineworld share price is trading sideways within a range bordered by the resistance zone at 69.72/71.56, and the 60.26 support level. Price needs to break out of this range to establish a direction. A break above the resistance zone opens the door for bulls to aim for 77.20. Additional price targets to the north come in at 82.32 (13 May/21 June lows) and 89.52 (16 February/23 June highs).

On the flip side, a continuation of the prevailing downward trend could ensue if the Cineworld share price action takes out 60.26. This scenario would allow the bears to aim for 52.64 (26 November 2020 low). 44.94 is additional multi-year support which becomes available if the 52.64 support level gives way.

Cineworld Share Price (Daily)

Follow Eno on Twitter.