- Summary:

- A break of the 22.71 resistance is required for the Cineworld share price to continue the recovery in the short term.

The Cineworld share price recovery continued on Friday with the 1.96% upside move, which could let the stock end the week higher if it closes at these levels or higher. Following a bounce from the $17 psychological support, the Cineworld share price has made a slow and steady recovery after the downtrend move from the 17 March peak faltered with the formation of a pinbar and a doji candle (14/15 July candles).

The cinema chain saw an improvement in its 2021 revenues but still lags behind its pre-pandemic numbers. Its 2021 losses narrowed to $708 million as the company’s cinemas opened their doors following the end of lockdowns. Despite the recovery, the medium-term outlook remains grim as the company groans under a huge debt pile.

It presently owes more than $8 billion to its creditors and former Regal shareholders and has sought deferment of required payments to settle these debts several times. The Cineworld share price recovery beyond present levels would require the release of more blockbuster movies in the mould of “Spider-Man: No Way Home” and “Top Gun: Maverick”.

But there are potential headwinds. While the threats of any new lockdowns from COVID-19 are getting more distant, immediate challenges could come from global recession. As inflation wipes out consumer spending power and interest rates rise, the spending habits of moviegoers could change, which could negatively impact ticket sales.

The Cineworld share price also remains vulnerable to the company’s court-induced indebtedness to Cineplex. Cineworld was ordered by a Canadian court to pay Cineplex $971 million for a failed merger. If the company’s appeal against this judgement fails, the Cineworld share price could take a further hit.

Cineworld Share Price Forecast

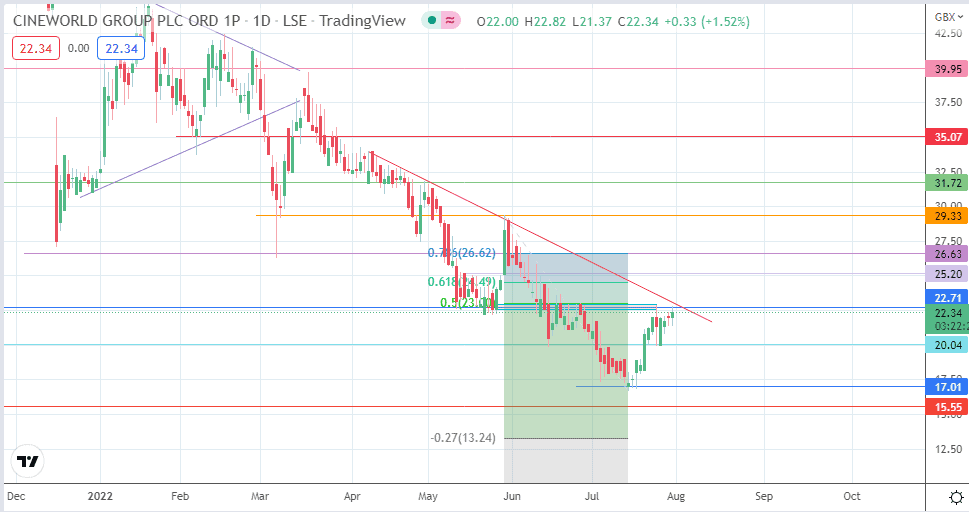

The descending trendline that connects the peaks from 8 April to date and the 22.71 price resistance (50% Fibonacci retracement from the 30 May swing to 14 July swing low) represent the barriers that the bulls must break to extend the recovery move. 25.20 (61.8% Fibonacci retracement level) and 26.63 (9 June 2022 high/78.6% Fibonacci retracement level) are the initial targets of the renewed recovery. Above these levels, the 30 May high at 29.33 and the 2 April high at 31.72 are the additional price targets to the north.

On the other hand, rejection at 22.71 truncates the recovery and provides a re-entry opportunity for short positions seeking 20.04 (16 June and 25 July) and 17.01 (18 July low) as initial harvest points. The downtrend move is reinforced with a breakdown of the 15.55 support (5 October 2020 low), with the 13.24 (27% Fibonacci extension) and 8.83 (61.8% Fibonacci extension level) serving as additional targets to the south.

CINE: Daily Chart