- Summary:

- The make-or-break month for Cineworld's share price will be in October when the appeals court finally rules on its $970 million appeal case

The make-or-break month for Cineworld’s share price will be in October when the appeals court finally rules whether the company will be liable for $970 million in damages. However, for now, the company’s share price has continued to struggle in the markets and is already down by 8 percent this month.

Investors looking at the company have been forced to weigh a scenario where the appeals court rejects Cineworld’s arguments and forces them to pay. With the company’s debt already a problem, with a rating of CCC by S&P Global Ratings, which is the eighth level below investment grade, such a ruling would be devastating for the company.

The year-to-date data is also not on Cineworld’s side, with the company losing almost two-thirds of its value during the period. Therefore, investors are also wary of the possibility that a default on its debt is not out of the question based on the company’s current financial situation.

Cineworld Share Price Analysis

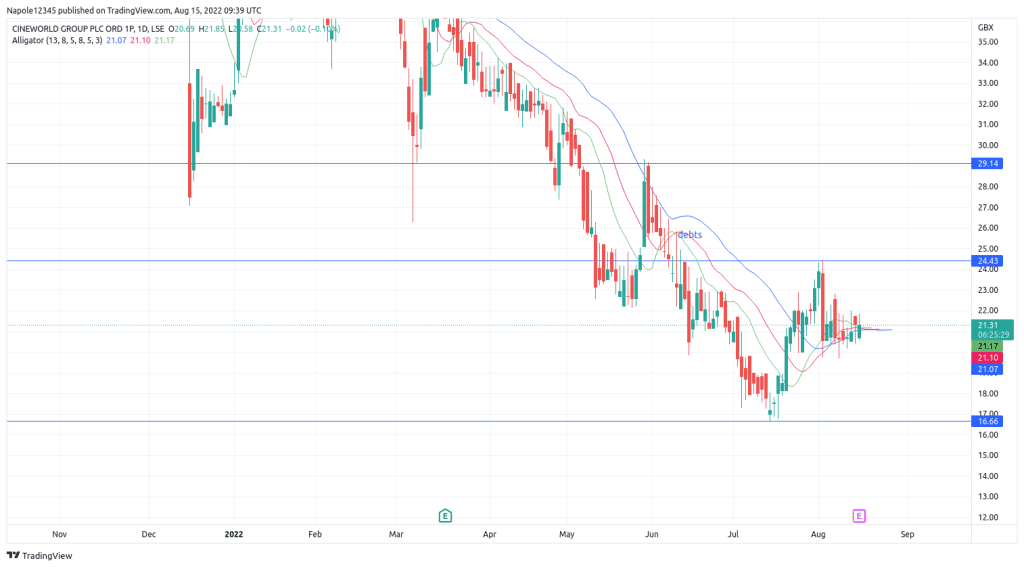

With the company’s mounting financial and legal troubles, my Cineworld share price prediction expects the prices to continue falling. As a result, there is a high likelihood that we may see the prices dropping below the 20p price level and possibly hitting the 16 demand level, as shown on the chart below.

Based on the chart, the past few trading sessions have been sideways after prices hit the 24 supply level and failed to break to the upside. The chart also shows that it is likely that the current bearish flag is in preparation for another strong bearish move. The technical signals, news of the company’s debt problem, and the impending case ruling indicate we are about to see a strong push to the downside.

However, should the prices hit the 24p supply level again, my analysis will be invalidated. It will also be a big sign of Cineworld’s share price recovery.

Cineworld Daily Chart