- Summary:

- The Chinese Yuan sold off on Thursday, triggering a return of risk-off sentiment and Yen demand across several Yen crosses.

Thursday saw the re-entrance of risk-off sentiment in Asian trading, sparked by a sharp sell-off of the Chinese Yuan. The Yuan hit the 7.0750 price level, marking lows which have not been seen since 2008. Chinese News Agency Xinhua quoted a spokesman for the Chinese Foreign Ministry as saying that China was ready to impose sanctions on US companies responsible for arms sales to Taiwan.

This drop triggered a selloff in the NZDUSD, causing it to fall to 0.6380 as at the time of writing. Asian stocks were also dragged down, while the Yen saw pickup in activity, with the USDJPY trading 0.3% lower at 106.41 and the AUDJPY trading at 71.97; well off its weekly high of 72.93.

Investors will look out for more comments from the key players in the US-China trade impasse, as well as Jackson Hole Symposium where global central bankers will converge to discuss issues around monetary policy. US Fed Chair Jerome Powell is expected to speak at this symposium.

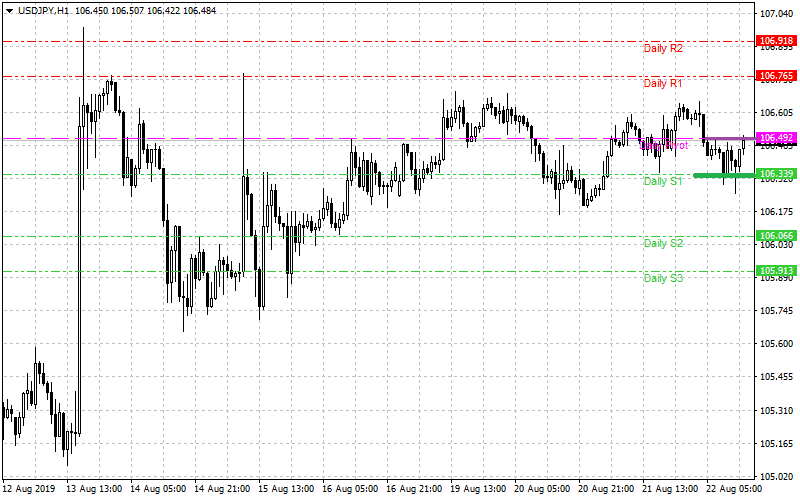

Technical Plays for USDJPY

After falling from the daily highs of 106.76 on the back of safe haven Yen demand, the USDJPY continues to trade in a tight intraday range that has 106.30 as floor and 106.49 as ceiling. Break above the 106.49 mark will open the door for a test of 106.76, while violation of the floor price of 106.30 will allow the pair retest the lows of August 16 at 106.03 and possibly 105.63.