- Crude oil prices may face additional headwinds in the coming days after China said it would release some of its strategic reserves.

Crude oil prices could face additional pressure in the coming days after China’s surprise oil reserve drawdown. The crude oil price recovered some of Wednesday’s losses, as short-sellers banked some gains from recent downside moves.

Crude oil prices had fallen steeply on Wednesday, losing 2.60% after China announced it would release crude oil from its strategic reserves. This announcement followed a virtual meeting between US President Joe Biden and his Chinese counterpart, Xi Jinping. The move by China to release some of its oil reserves countered the 2.1million barrel shortfall in US crude oil inventories as announced by the Energy Information Administration yesterday.

Crude oil price on the Brent benchmark hit its multi-year high on 25 October at 86.68. However, worries of a potential move such as the one pulled off by China got investors worried, which started the correction. The move by China could take some days to be fully priced into the market. Despite the price uptick by 0.85%, crude oil prices could face headwinds in the coming days.

Crude Oil Price Outlook

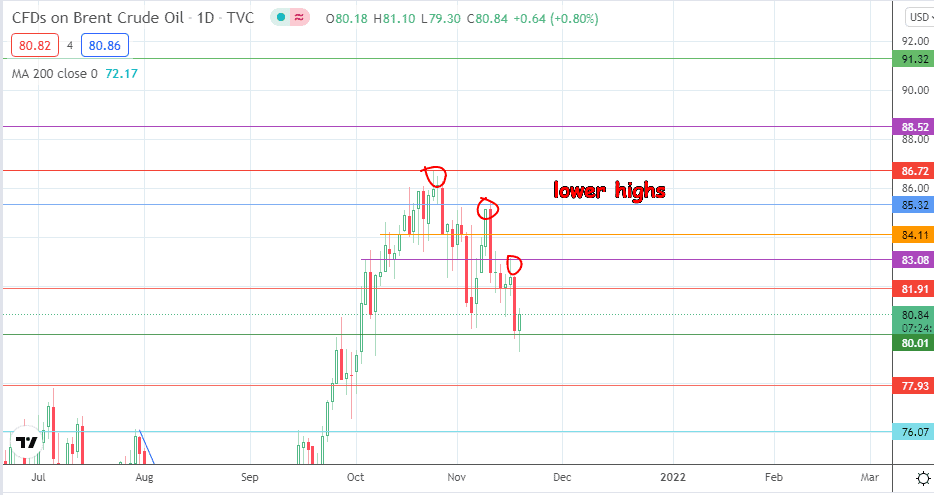

The daily chart on Brent crude features progressively lower highs. This needs to be followed by a drop below the 80.00 support level to form an additional lower low that follows those of 29 October and 5 November. A breakdown of the 80.00 psychological support delivers this setup and opens the door towards the 77.93 price mark. A further decline targets 76.07 (29 July and 15 September highs).

On the flip side, a break of the 83.08 resistance truncates this setup and allows for a potential push towards 84.11 and 85.32 (19 October and 10 November highs). A break of 86.72 restores the uptrend recovery move and opens the door to another multi-year high at 88.52.

Crude Oil (Brent): Daily Chart

Follow Eno on Twitter.