- Summary:

- Continued US-China trade war shows no signs of abating as China announces tariffs on US imports;to commence September 1 and last till December 15,

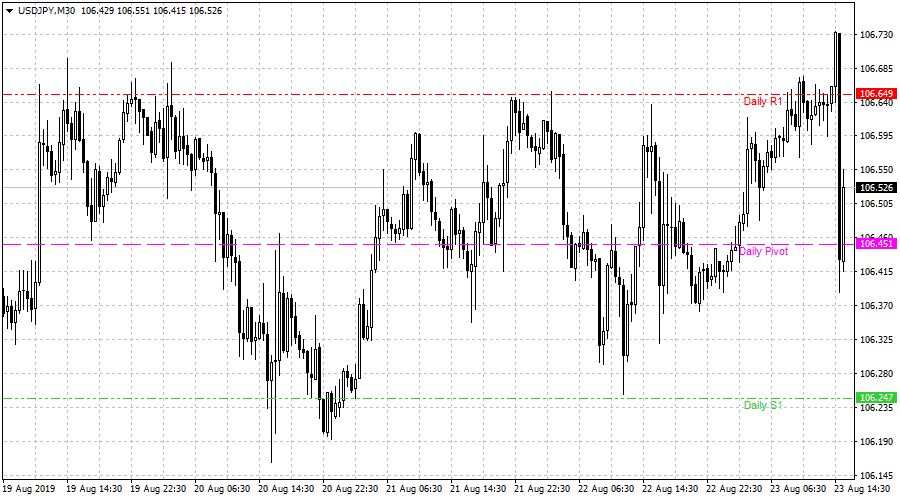

The USDJPY has just taken a double hammer blow from a major US-China trade war headline as well as dovish comments from St. Louis Fed President James Bullard on Bloomberg TV.

The Reuters news wires have just confirmed an earlier report from Global Times that China has announced plans to impose tariffs on certain US imports. According to the statement from Beijing, “new tariff rates will apply to about $75 billion worth of US goods…New tariff rates imposed on some US goods will be ranging from 5% to 10% and will take effect on September 1 and December 15.”

Similarly, the news wires have reported on St. Louis Fed Reserve Bank President James Bullard’s speech on Bloomberg TV, where he has indicated that there “will be a robust debate about a 50 basis point cut at next meeting”. This has suddenly reignited hopes that there could be a series of cuts, or one aggressive rate cut at the next FOMC meeting.

Speaking during the interview with Bloomberg TV on Friday, Bullard said that the Fed would have to react in what he termed “downdraft in global yields.” Bullard has also indicated the willingness of the Fed to react in order to continue expanding the US economy. Bullard also expressly stated his belief that lower rates would be a good tool to help the US navigate the troubled waters of the trade war.

As a result of these comments and the tariff retaliation from China, the USD is losing ground against the Yen and is trading at 106.48 as at the time of writing, about 20 minutes off its intraday high.

The markets continue to await the speech by Fed Chair Jerome Bullard at the Jackson Hole symposium.