- Summary:

- Chainlink's price is up by 4 per cent. Today’s surge breaks a streak of the past five days that has seen it drop by 13 per cent.

Chainlink’s price is up by 4 per cent. Today’s surge breaks a streak of the past five days that has seen it drop by 13 per cent.

Chainlink Price Prediction

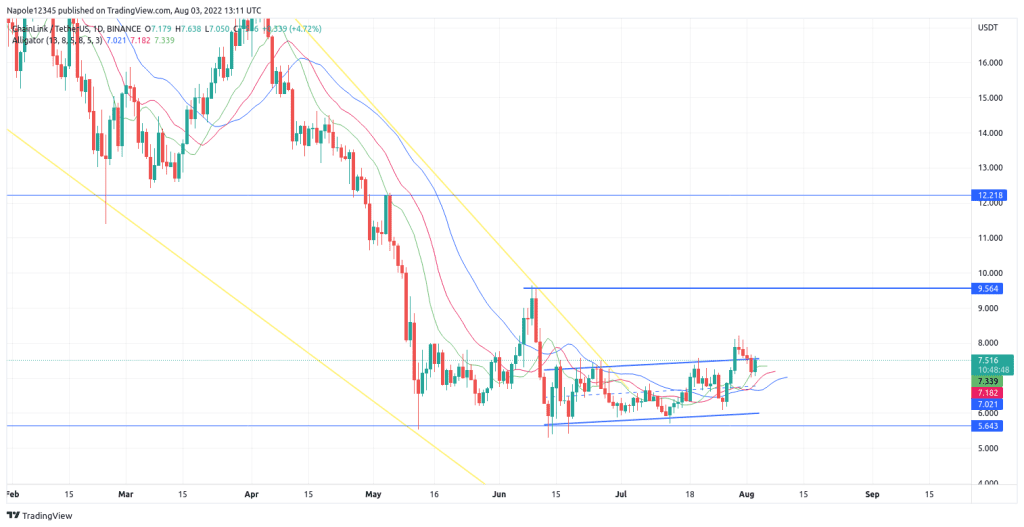

Interestingly, Chainlink has traded within an ascending channel for more than a month. However, on July 29th, the prices broke out of the ascending channel structure to the upside before failing to gain momentum and continue pushing upwards.

The result was a five-day price drop that saw the prices hit the upper trend line of the ascending channel and the prices returning inside the ascending channel. However, looking at today’s trading session, the current bullish move of 4 per cent has pushed the prices slightly above the upper trend line of the channel.

Moreover, the trading session is also looking aggressively bullish, meaning there is a high likelihood of the trend continuing throughout the session. If that is the case, I expect the prices to continue moving further away to the upside from the upper trend line.

Looking at the chart below, the current momentum is likely to continue even in the next few trading session. Based on the current price action, I expect the prices to hit the recently set price high of $9.5. There is also a high likelihood that we wil see the prices trading above the $10 price level.

My bullish chainlink price analysis is also supported by fundamental factors such as the continued development of the platform, including a recent report indicating a chainlink demand wall at $6.7, where 7,000 addresses have bought nearly 301 million LINK tokens. So far, the demand level has held true, indicating the likelihood of investors continuing to push the prices higher.

However, my analysis will be invalidated if the prices fall below the demand wall of $6.7. At that point the bears will have won.

Chainlink Daily Chart