- The Chainlink price has been under intense pressure in the past few days. LINK is trading at $25. What next for LINK?

The Chainlink price has been under intense pressure in the past few days. LINK is trading at $25, which is about 12.45% below last week’s high. This price is about 52% below its highest level last year, bringing its total market capitalization to over $11.7 billion.

Chainlink is one of the most useful blockchain platforms in the world. Unlike platforms like Solana and Ethereum, Chainlink has no major competitors. Instead, it offers smart oracles that help other blockchain networks in many ways.

For example, DeFi platforms like Aave and Uniswap use its products to provide accurate data. It is also used by other platforms to connect off-chain data to on-chain data. For example, developers can simply connect data from the Weather Channel to the network.

Chainlink also launched a new product known as Keepers in 2021. Keepers is a product that helps developers to trigger or initiate functions at arbitrary times. This technology is compatible with Ethereum, Binance Smart Chain (BSc), and Polygon platforms.

Chainlink recently made headlines when it hired Eric Schmidt to its board. Eric is one of the biggest players in the technology industry. He is the former Chief Executive and chair at Google. According to Forbes, he has a net worth of over $23 billion.

Therefore, there is a likelihood that he will validate Chainlink’s technology and possibly introduce new partnerships.

Chainlink price prediction

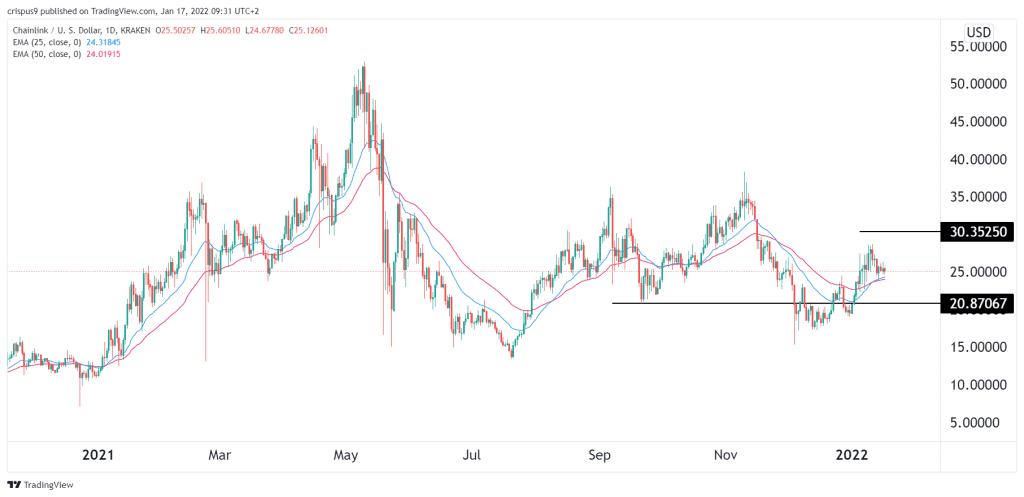

The daily chart shows that the LINK price has been under pressure in the past few days. It has declined by about 12% below the highest level last week. It moved slightly above the 25-day moving average. Also, it has moved above the key support at $20.87, which was the lowest level since September 22nd.

Therefore, the Chainlink price will likely keep rising as long as it is above the two moving averages. If this happens, the next key level to watch will be at $30. However, a move below the key support level at $22 will invalidate the bullish view.