- Summary:

- Chainlink price prediction depends on the bulls' ability to reclaim the $9.50 level. A breakout might trigger a bullish move till $18.

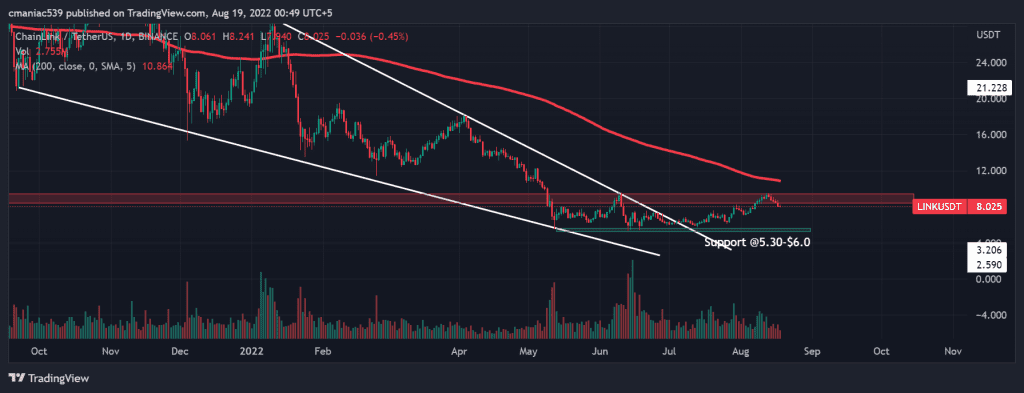

Our Chainlink price prediction might become fairly bullish if the price reclaims the $9.50 level. This region has been acting as a resistance for LINK crypto since the price broke below it in May 2022. The price has attempted a breakout twice but failed both times. A daily closure above this level could trigger a huge bullish move.

Cryptocurrencies have been facing increased selling pressure since the start of this week. The week started with the BTC price getting rejected from the $25k level. The market was quick to react to this pullback, and most altcoins turned red immediately.

At the time of writing, Chainlink price is trading at $8.02. The price lost 0.2% during Thursday’s trading session. Nevertheless, the market structure on the daily timeframe is still intact, and another retest of the resistance is quite likely.

According to Chainlink news today, Kyber Network has integrated Chainlink for assistance in DAO and DeFi operations. The price feeds from the top oracle have been integrated on Arbitrum, BSC, Avalanche, Ethereum, Optimism, and Polygon. You can trade all these cryptocurrencies on top crypto exchanges like Binance.

Chainlink Price Prediction

Technical analysis of the LINK USD price chart shows a clear breakout of the falling wedge pattern. Although falling wedges are bullish patterns, the LINK coin couldn’t gain much momentum after the breakout. Nevertheless, the price has kept making higher highs and higher lows on the 1D timeframe. The bulls are still very much in the game and might retest the $9.50 zone very soon.

Therefore, Chainlink price prediction depends on the bulls’ ability to reclaim the $9.50 level. A confirmed breakout above this level would create a further upside. In such an event, bulls might target the 200-day moving average at $10.86 or the 0.382 Fib retracement zone at $18.

It is also worth mentioning here that Link Coin price is very strongly correlated to the price action of Bitcoin. Therefore, a big correction in BTC would create an immediate sell-off in Chainlink.