- Summary:

- The CFTC Commitment of Traders Report shows that safe haven plays are dominating speculative action on the currency majors.

The latest CFTC Commitment of Traders Report shows that the net long positions on the USD fell moderately last week; the first weekly fall since mid-June. The highlights of the report for the week ended on August 13 are presented below.

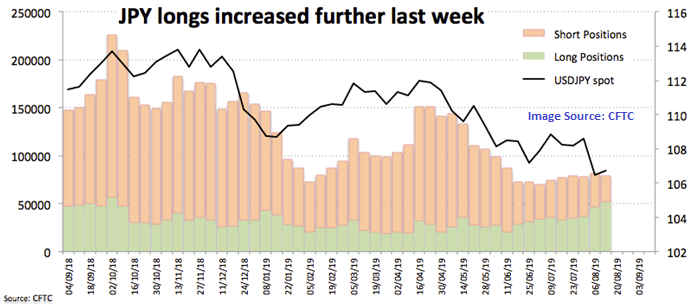

- Safe haven demand that has pervaded the markets in the last two weeks pushed speculators to increase their long positions on the JPY, taking the net longs to the highest levels in 33 months.

- More risk-off sentiment caused a drop off in the speculative net short positions on the CHF.

- Speculators also reduced their net long positions on the USD, driving them to three-week lows as bets increase for further rate cuts by the Federal Reserve in response to global economic weakness.

- The report also noted that there was an increase in AUD net shorts, driving them to two month-highs on the fears that the unresolved US-China trade war could have negative effects on the Australian economy and force the hand of the Reserve Bank of Australia into an easing cycle.

- There as an increase in net EUR shorts, but not so much as to cause an increase beyond the numbers seen in late July.

- For the first time in 12 weeks, net short GBP positions dropped, perhaps on expectations that the Brexit process would still be rescued with a deal.

- There was a sharp drop in the net long positions for the CAD as markets have begun to increase the odds of a possible rate cut by the Bank of Canada in the not-too-distant-future.