- Centrica share prices have dropped in the last two trading sessions. Today's trading session, although opened higher than yesterday's prices.

Centrica share prices have dropped in the last two trading sessions. Although it opened higher than yesterday’s, Today’s trading session has continued the downward trend.

Understanding Current Price action through Fundamentals

The current drop in price may be temporarily based on the fundamentals that have made the Centrica oil sales dip. The soaring energy prices across the UK and most countries are likely to hurt the company’s profits. This is according to Motley Fools Christopher Ruane, who points out that the risk is tied to uncertainty in gas prices. The company, which mainly deals with electricity and gas to consumers in the United Kingdom and Ireland, has become a casualty of Russia’s Ukraine invasion, which has caused the price increase.

However, in the long-term, the company is positioning itself for the future. This includes recent decisions such as the sale of its Direct Energy, its US division for £2.7bn and its Norwegian oil and gas assets. These moves are likely to make the company focus on its core operations, making it a consistent financial performer, according to Ruane. It will also shape how Centrica share prices react move in the future.

Centrica Share Price Prediction

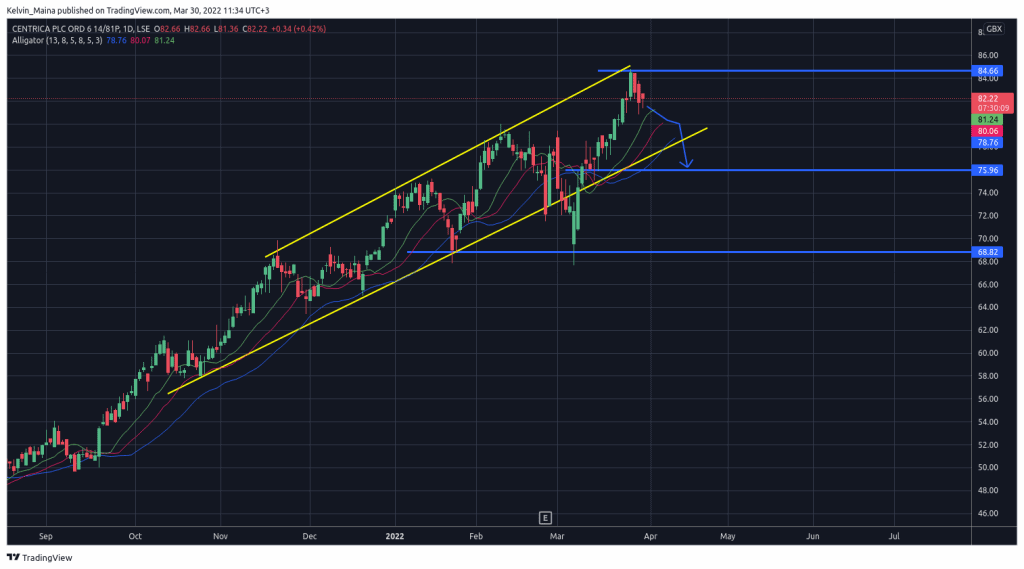

Centrica’s focus on the markets has been geared toward its long-term goals, as shown in the fundamental analysis above. However, Today’s price action does not reflect those sentiments. On the daily chart below, we can see that the prices have dropped Today for the third consecutive day. The prices are also trading three per cent below what the share price was three days ago.

On the chart, we can see that the share prices have been trading within an ascending channel. We can also see that the current push to the downside comes after hitting the upper trend line of the channel and setting new yearly price highs of GBp 84.54. By combining these three factors, my Centrica share price prediction will continue its downward trend until it hits the $75 support level. This analysis is in line with other fundamental analysts who see the company’s rise in gas prices as a negative.

Centrica Daily Chart