- Summary:

- Today’s trading session marks the second consecutive trading session that Centrica's share price is dropping in the markets.

Today’s trading session marks the second consecutive trading session that Centrica’s share price is dropping in the markets. The share price opened the markets, trading at 87.50p after a huge up gap of 2.5 per cent. However, the intraday trading in the past few hours has seen Centrica’s share price continue to fall and is currently down 1.8 per cent from its opening price.

In the latest financial report, Centrica recorded an impressive half-year profits that were five times higher than a year earlier. For the first six months, the company indicated that it made an adjusted operating profit of £1.34 billion, up from 262 million a year earlier.

The company’s profit windfall saw it reinstate paying dividends to its shareholders. According to reports, the company announced that it had brought back an interim dividend of 1p per share that it had scraped three years earlier.

The decision to reinstate dividends was met with criticism due to the rising cost of energy cost in the UK. One analyst even described the situation as unsurprising due to the high cost of energy that is likely to see energy bills in the UK hit 4,000. In addition, he argued that any energy company making a profit for its shareholders at this time is expected to face backlash. However, despite the criticism, the company’s profits look to not have impacted its market share price.

Centrica Share Price Analysis

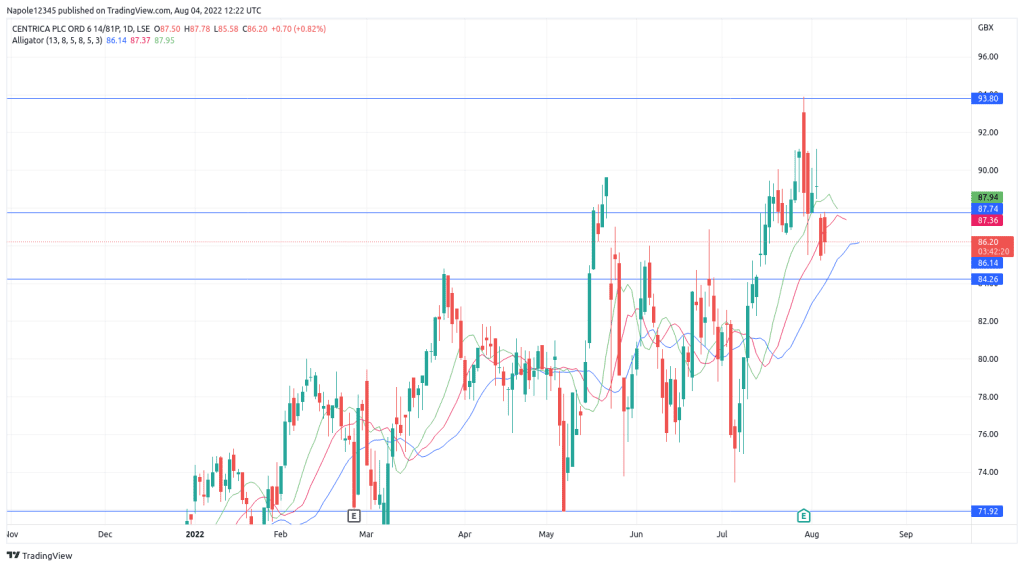

Looking at the daily chart below, we can see the news of the strong half-year performance did not highly impact Centrica’s share price. In fact, the share price has been falling for the past few trading sessions.

Looking at the chart, however, I expect the prices to recover and resume the upward move. We will likely see Centrica’s share price trading above July’s price high of 93p in the next few trading sessions. I also expect August to be as bullish as July was.

My analysis will, however, be invalidated should the prices fall below the 84p price level. At that point, a bear trend will not be surprising.

Centrica Daily Chart