- Summary:

- The Centamin share price pared some of its losses after the company announced it would pay dividends of $0.05 per share.

The Centamin share price has pared some of Wednesday’s losses, which had resulted from below-par full-year earnings released to the market on the same day. Centamin had reported full-year earnings of $0.08738 per share on revenue of $733.3m. This was lower than the previous year, where the earnings per share stood at $0.13453, with revenue of $828.7m. The figures also fell short of analysts’ expectations, indicating earnings of $0.11 per share on a $734.9m revenue projection.

However, Centamin also proposed a dividend payment of $0.05 per share, which may have resulted in the demand for the stock that was seen in Thursday’s trading session. The earnings report had triggered a massive slide on Wednesday, where the stock lost 9.35%.

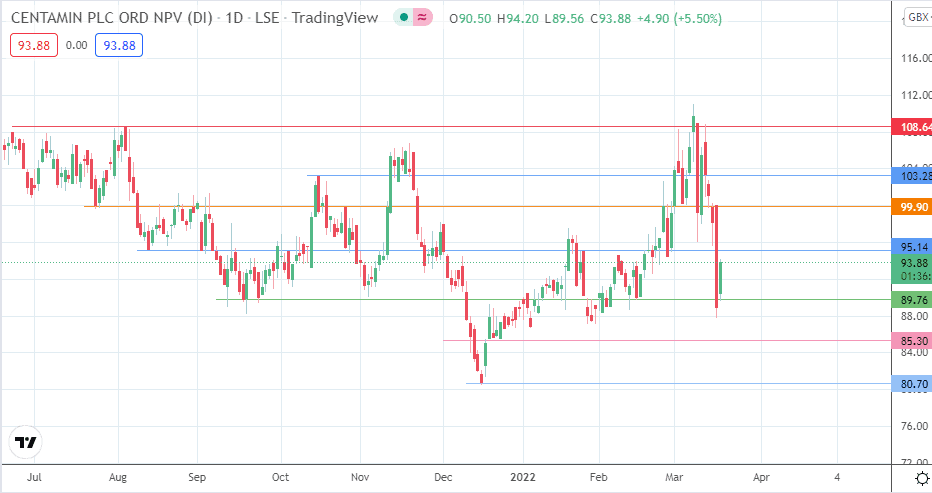

The recent upsurge in the Centamin share price was unable to breach the 4 August 2021 high at 108.64, leading to a descent from that high to the current price mark at 93.04. This followed a rejection of Wednesday’s violation of the 89.76 support level. This rejection has resulted in a 4.56% uptick on the day as of writing.

Centamin Share Price Outlook

The Centamin share price’s uptick on the day has failed to meet the immediate upside target at the 95.14 resistance. If there is enough momentum to the upside to test and break this resistance, then 99.90 becomes the new upside target. The resistance barriers at 103.28 (15 October 2021 and 4 March highs) and 108.64 (11 March high) will become viable if the advance exceeds 99.90.

On the flip side, the bears would seek a breakdown of 89.76 to continue the preceding 4-day drop, targeting 85.30 initially (22 December 2021 low) before 80.70 (15 December 2021 low) enters the picture an additional southbound target.

Centamin: Daily Chart

Follow Eno on Twitter.