- Summary:

- The Carnival share price continues to struggle for recovery momentum despite increase in bookings from relaxed COVID-19 testing rules.

The Carnival share price is down in premarket trading, but the stock remains up for the month as the company continues to see increased booking activity this holiday season.

Three days ago, Carnival’s Holland America Line opted to ease COVID-19 protocols for cruise guests from early September. The new rules will allow vaccinated guests to undergo voyages of up to 15 nights without being tested. Unvaccinated guests will be subject to self-testing within three days of sailing. However, these guidelines will not be applicable in Australia, Canada, and Greece as local restrictions apply in these countries.

The rules change with more extended travel. All passengers, vaccinated and unvaccinated, who are embarking on journeys above 15 days, will need to take a medically supervised test and have a negative PCR result within three days of boarding. There is also room for unvaccinated travelers to get a medical exemption if required.

The Carnival share price was one of the worst-hit during the early months of the pandemic. Despite some recovery in its operations, the Carnival share price continued to dip, bottoming out just above all-time lows. The latest attempt to break out of the consolidation to further the recovery has stalled, despite booking activity hitting twice the August 2019 numbers.

Carnival Share Price Outlook

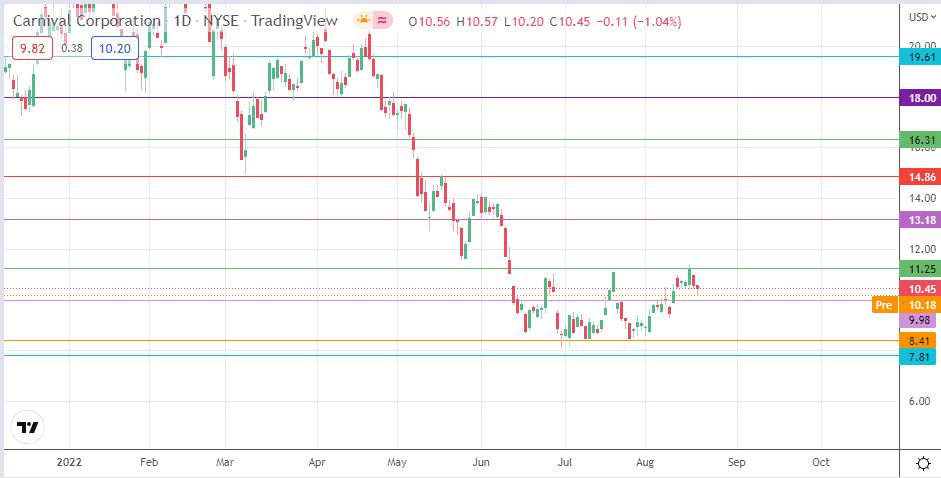

The price action continues to trade in a range that has 11.25 as the ceiling and 8.41 as the floor. There is an intervening barrier at 9.98 (15 June high and 19 July low), currently serving as a support level. If the bears break down this obstacle, the pathway will be clear for a push toward the 8.41 floor (11 July/26 July lows). If the floor bows to bearish pressure, the all-time low at 7.81 (2 April 2020 low) becomes the next target in line for the bears.

Conversely, a bounce on 9.98 makes the ceiling of the range vulnerable. If the bulls succeed in uncapping this barrier, the 13.18 price mark (23 May high and 1 June low) becomes a viable new target to the north. The 18 May high at 14.86 and the 8 March/6 May highs at 16.49 become additional harvest points for the bears if the advance continues.

Carnival Corp: Daily Chart