- Summary:

- The Carnival share price is trading in murky waters as it hits the Citibank downgraded price target to seal a 4th day of losses.

The Carnival share price continued to trade in troubled waters nearly two weeks after Citi downgraded the company’s stocks. Citi had recommended the stock to be a “hold”, down from a previous “buy” recommendation. The investment bank also reduced its price target for the stock from $34 to $24.50.

Since then, the Carnival share price has pursued an aggressive path to the downside, stabilizing around the Citi bank price target. The Carnival share price is down 0.6% on the day, on course for a 4th losing session.

Carnival Share Price Outlook

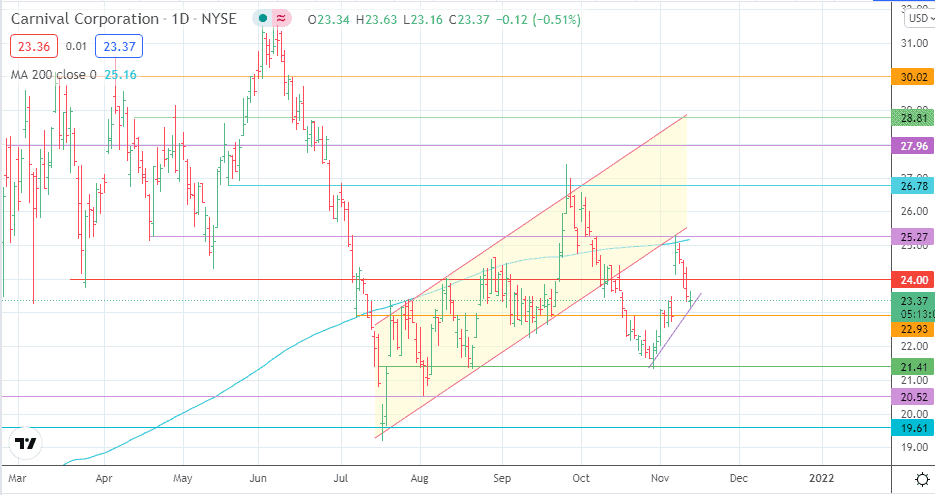

The decline followed a price rejection at the 200-day moving average, just below the 25.27 price mark. This decline has taken out the 24.00 psychological support and aims for the 22.93 support as the immediate downside target. A further decline targets 21.41.

On the flip side, bulls need a recovery bounce, coming from the current ascending trendline. This bounce has to take out the 24.00 price mark and the 25.27 resistance (along with the 200-day moving average) to attain the 26.78 resistance barrier. Above this level, 27.96, 28.81 and 30.02 are additional targets to the north.

Carnival Corp: Daily Chart

Follow Eno on Twitter.