- Summary:

- What is the forecast for the Carnival share price as the company nears a new management change? We explain whether CCL is still a buy

The Carnival share price is in the spotlight after the company made management changes this week. As a result, the CCL stock crashed by more than 7% in New York. It also declined by more than 2.4% in London and is trading at 1,284p. This price is about 22% above the lowest level in March. Its market cap has moved to about $17 billion, making it the biggest cruise line globally.

CCL management change

Carnival and companies like Royal Caribbean and Norwegian have been in a strong recovery mode as the world continues to reopen. The latter two firms have all said they expect to move back to profitability in the second quarter, while Carnival has said it will become profitable in Q3 of this year.

They have also said that they are seeing robust demand for their solutions. Further, Carnival has said that about 75% of its ships were all in operation while the rest will start their services in the coming months. However, the Carnival share price has been in a bearish trend as investors worry about the rising cost of doing business. It has been forced to pay more money for fuel and wages.

Another risk for Carnival and other cruise lines is that the Covid-19 pandemic is still around. The US is even reporting over 40,000 new cases every day while China has locked down some cities.

The Carnival share price will be watched closely after the firm announced that it would replace its CEO. Arnold Donald, who has been CEO since 2013, will now be replaced by Josh Weinstein, the current Chief Operating Officer. He has been in the company for over 20 years and helped shepherd the company during the pandemic.

Carnival’s balance sheet has become strained recently. For example, it has over $6.93 billion in cash and over $36.23 billion in debt. In addition, its short-term debt is $2.74 billion, which is a substantial amount. As a result, according to Moody’s, the company has a B1 rating, which is four notches deep into junk territory.

Carnival share price forecast

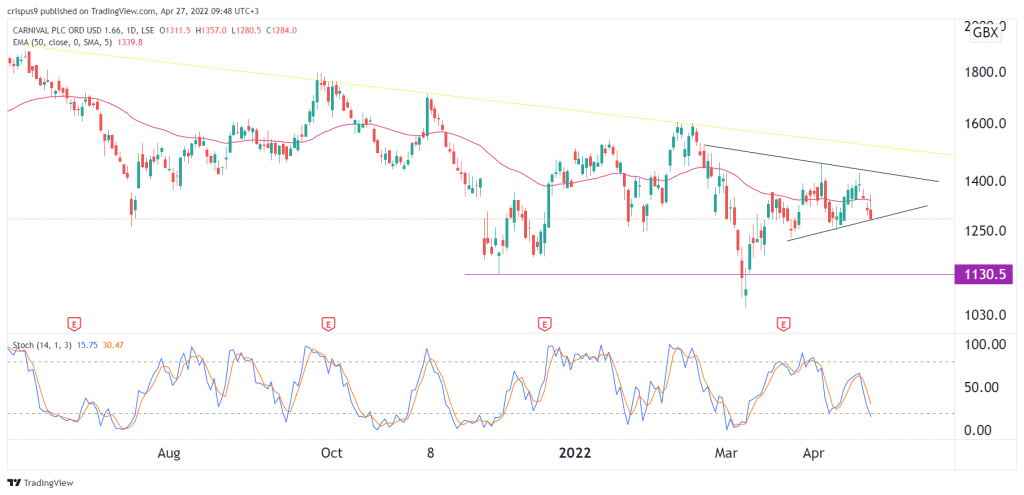

In my last note on Carnival, I noted that the firm faces an uphill path to recovery. Turning to the daily chart, we see that the CCL share price has been in a strong bearish trend in the past few months. The shares have moved below the descending trendline shown in yellow. It has also dropped below the 50-day moving average while the Stochastic oscillator. It has also formed a small symmetrical triangle pattern shown in black.

Therefore, the Carnival stock price will likely keep falling, with the next key support level at 1,1130p. This price is about 12% below the current level.