- Summary:

- The Carnival share price has been under pressure in the past few days as worries of the Omicron variant remains.

The Carnival share price has been under pressure in the past few days as worries of the Omicron variant remains. The CCL stock erased all the gains it made on Wednesday in New York after the US confirmed its first Omicron variant case. It then dropped to a low of $16.38, which was the lowest level since November last year.

Carnival is the world’s biggest cruise line company with a market cap of more than $20 billion. The company is followed by firms like Norwegian and Royal Caribbean. These firms have gone through a difficult patch in the past two years because of the Covid-19 pandemic.

Recently, there have been hopes that the industry will rebound. Besides, most people have been vaccinated and more countries have reopened. Indeed, the company was expected to become profitable in 202 and averted a liquidity crisis. However, the current Omicron variant has helped to undo most of this optimism since it seems to be evading vaccines.

While I believe that investors are overreacting, the virus itself could lead to sluggish demand for cruises. New restrictions could pose substantial risks for the company because of its substantial debt.

Carnival share price forecast

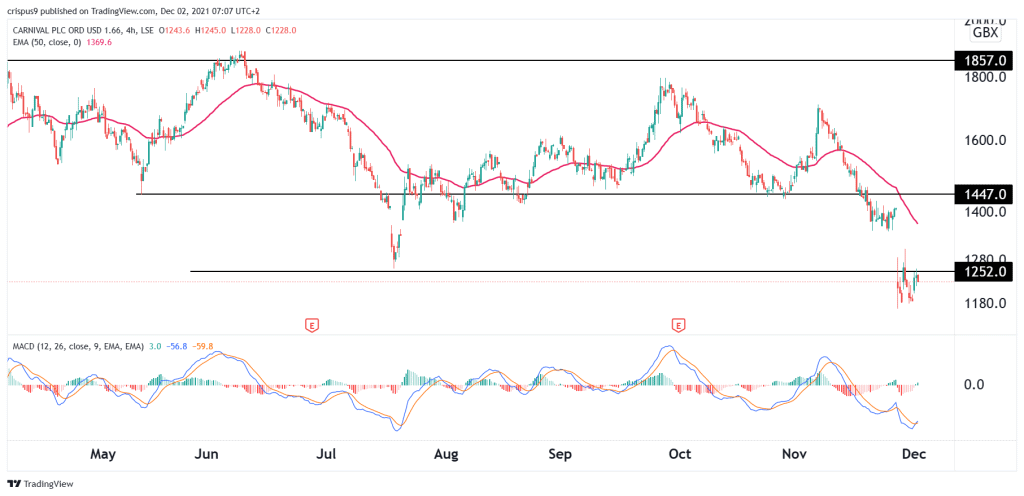

The four-hour chart shows that the Carnival stock price has been in a major bearish trend in the past few weeks. The stock has crashed by more than 30% from its highest level in September this year. It also formed a major bearish gap on Friday last week.

Carnival moved below the 25-day and 50-day moving averages. It has also moved below the key support level at 1,450p, which was the lowest level on May 13 and October. It was also the neckline of the double-top pattern.

Therefore, I suspect that the stock will keep falling as investors reflect more on the Omicron variant. This could see it crash to a low of 1,100p. This view will be invalidated if the price moves above the key resistance at 1,350p.