- Summary:

- Carnival share price is up slightly as the company launches a debt note worth $2billion, payable at a rate of 6% per annum.

The Carnival share price is down as travel stocks continue to take a beating in the markets. Carnival has offered $2.0 billion 6% unsecured notes, which have an 8-year maturity. The note offering remains open until November 2, and interest will be paid twice a year, starting 2022 at a 6% rate per year.

Carnival has said it will use the proceeds from the sale to start repaying the principals on its debt. The company had earlier in the week announced a $2billion term loan facility for refinancing of its debts, savings interest and extending maturities, as per a Reuters report.

Carnival share price is up 1.20% as of writing.

Carnival Share Price Outlook

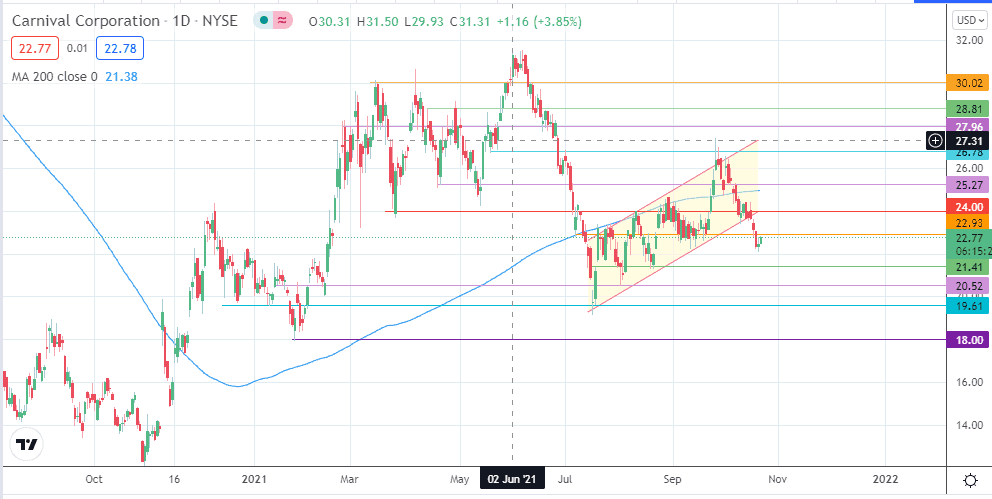

The Carnival share price completed the bearish flag after the breakdown of the 24.00 support. The completion move is on, violating 22.93 and Carnival appears set to continue the decline. The measured move calls for further downside towards 18.00, which puts 21.41, 20.52 and 19.61 at risk.

On the other hand, any upside moves towards 22.93 and 24.00 may present re-entry opportunities for sellers. If the price advances above the 200-day moving average at 25.27, this scenario invalidates the pattern and the measured move. This scenario then calls for a rally towards 26.78, with 27.96 serving as an additional target.

Carnival Share Price (Daily)