- The Carnival share price is in a tight range as investors continue watching the company's reopening. The CCL stock is trading at 1,600p

The Carnival share price is in a tight range as investors continue watching the company’s reopening. The CCL stock is trading at 1,600p, which is about 11% below this month’s high of 1,800p.

Carnival relaunch

Carnival is the biggest cruise line in the world. The company has a market capitalisation of more than $26 billion, which is substantially higher than that of Royal Caribbean and Norwegian.

Carnival and other cruise lines have had a difficult period due to the pandemic. The pandemic forced most of these companies to shut down their business.

This year has been relatively different as the industry makes a slow recovery. Carnival has already relaunched some of its ships and it now expects to have about 17 ships at sea by the end of the year. The company expects to restart its US operations in January and February next year.

There are signs that the industry is recovering substantially. Data published this week showed that cruise line spending improved to – 49% in September vs the September 2019 level. This was a modest improvement from – 59.5% in August and -60.6% in July. While the industry is still struggling, there are signs that it is moving in the right direction.

Meanwhile, the Carnival share price is reacting to news that the company managed to raise $2.3 billion last week. The company raised these funds through a term loan facility due 2028. It will use these funds to finance the redemption of 11.5% first priority senior secured notes due 2023. This capital raise means that the company will not have a liquidity crisis any time soon.

Carnival share price forecast

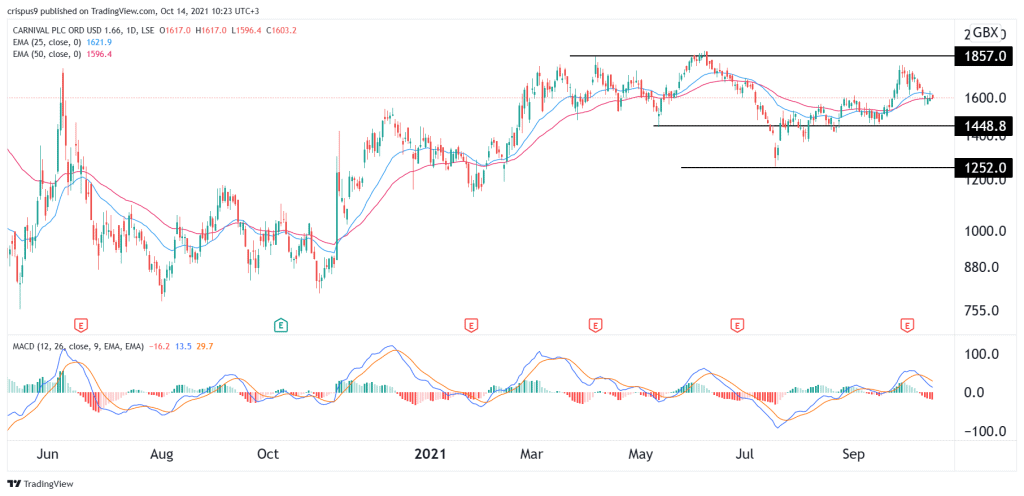

Turning to the daily chart, we see that the Carnival share price has been in a tight range in the past few weeks. The stock is trading between the key support at 1,448p and resistance at 1,857p.

This consolidation has pushed the stock to the 25-day and 50-day moving averages. It also seems like it has formed a double-top pattern, which is usually a bearish signal. The chin of this pattern is at 1,252p, which is about 20% below the current level.

Therefore, in my view, I suspect that the stock will break out lower as bears target the chin at 1,252p. This view will be confirmed if the price manages to move below the key support level at 1,448p. On the flip side, a move above the resistance at 1,800p will invalidate the bearish view.