- Summary:

- The Cardano price predictions are likely to be dictated by the negative crypto market sentiment ahead of the Vasil hard fork.

Today’s intraday decline has dampened the Cardano price predictions of a recovery, stoked by the 3-day gains the ADA/USDT pair had prior to today. The ADA/USDT pair is down 6.89% on the day due to a return of sour sentiment on the market than on the token’s fundamentals.

Regulatory action is being ramped up worldwide in response to the Terra/UST debacle, which has soured sentiment in the crypto market this Monday. However, despite the recent downturn in the crypto market and Cardano price’s established struggles, the project is still on track to deliver the scheduled Vasil upgrade.

This was made known by the IOHK/IOG Founder, Charles Hoskinson. In a recent YouTube video, Input-Output Global’s Founder Hoskinson said the Vasil Hard Fork would come on stream on 29 June 2022. The testnet would be deployed towards the end of May, giving the IOG a whole month to prepare adequately for the seamless launch of the mainnet.

The Vasil Hard Fork is meant to introduce four new Cardano improvement proposals to boost the network’s performance. CIP-31, CIP-32, CIP-33 and CIP-40 are the improvement proposals to be launched, and Hoskinson believes these will send the total value locked (TVL) on the network upwards. However, it remains to be seen if these upgrades will result in bullish Cardano price predictions, allowing the token to experience a much-needed recovery.

Cardano Price Prediction

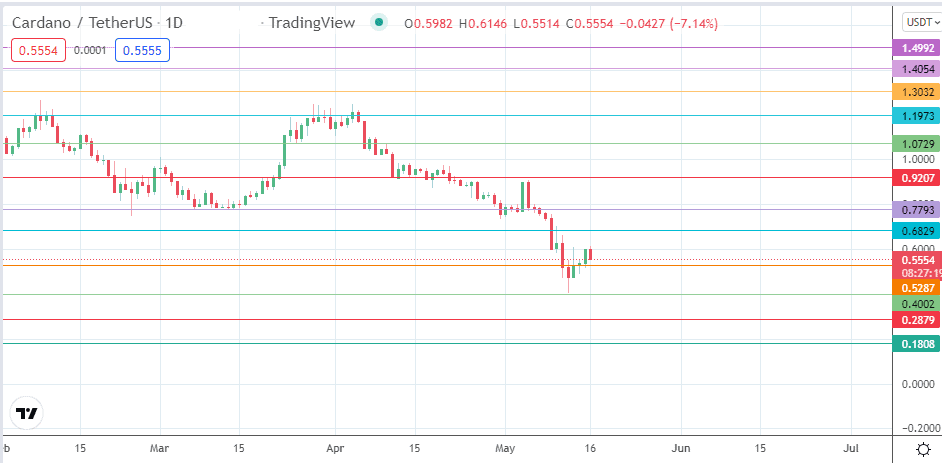

The recovery stays intact only if the bulls reject the intraday slide at the 0.5287 support. This rejection must translate into a bounce that overcomes the recent three-day high at the 0.6000 psychological price mark, targeting 0.6829 (10 May high). Additional targets to the north are found at 0.7793 and 0.9207 (27 February and 22 April highs).

On the flip side, recovery hopes fade if the 0.5287 support breaks down. This action clears the path towards the 0.4002 pivot, where the 20 January 2021 high and the 13 May 2022 low reside. Below this level, additional support targets are found at 0.2879 (17/22 January 2021 lows) and 0.1808 (4 January 2021 low).

ADA/USDT: Daily Chart