- Summary:

- Canadian Core Retail Sales beats market expectations, but USDCAD remains unchanged in choppy trading session on divergent comments from FOMC members.

July’s Canadian Retail Sales came in at 0%, which was marginally better than the -0.1% market consensus figure. The Core Retail Sales came in even better; it registered at 0.9% versus the 0.0% figure that analysts were expecting.

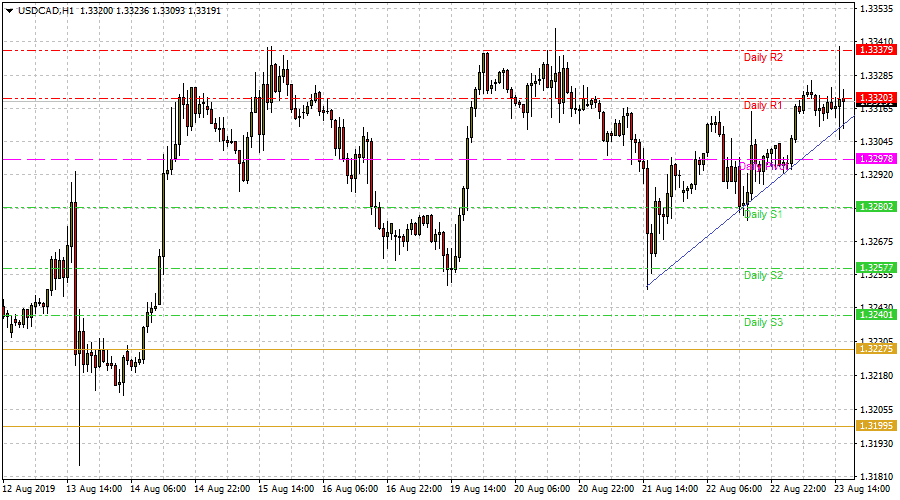

What followed on the USDCAD can best be described as a trader’s nightmare: the USDCAD spiked downwards and recovered afterwards in a whipsaw movement, as the USD is being affected by events elsewhere (the Jackson Hole Symposium). One FOMC member after another have been interviewed by Bloomberg and so far, there have been divergent opinions about interest rate direction.

St. Louis Fed President Bullard has hinted that a case for a 50bps rate cut would be made and discussed exhaustively at the next FOMC meeting, while Cleveland Fed President Loretta Mester has been guarded on what her vote would be, even though she subtly hinted that a downward recalibration may be needed if economic uncertainties continue. Dallas Fed President Robert Kaplan has clearly stated that current conditions do not call for a “rate cutting cycle”.

With these divergent comments, there is no clear direction for the greenback and the USDCAD continues to experience whipsaws. The pair is currently trading at the 1.3315 level (R1 pivot).