- The USDCAD has dropped 80 pips on the day, pressured by the better than expected core CPI report for July as well as stronger oil prices.

Canada’s Core Consumer Price Index for the month of July registered at 0.5%, which was better than the 0.1% that analysts had predicted. It was also better than the -0.2% figure registered for June 2019.

As a result of this upbeat report as well as good performance of crude oil prices this Wednesday ahead of the EIA Crude Inventories report, the CAD gained broadly against major currencies. USDCAD is now trading at 1.326326, translating to a nearly 80-pip gain for the Canadian Dollar over the greenback.

An analysis of the full report shows that increase in travel costs and gasoline prices were the main factors which pushed up the inflation figure. The lack of a broader foundational base for the higher core CPI tempered the market response to the news and has helped limit USDCAD’s drop.

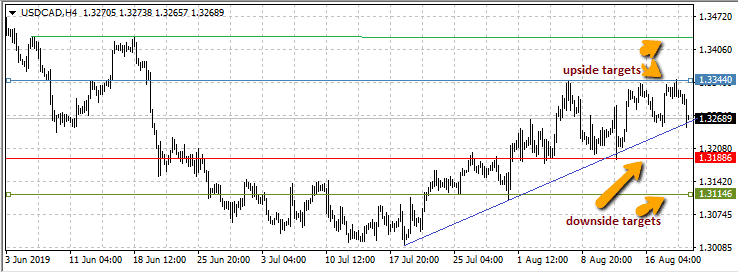

USDCAD is presently testing an ascending support trendline which connects the lows from July 17 till date on the 4-hour chart. A breakdown of this trendline will open the door for the USDCAD to test the downside targets at 1.31886 and 1.31146.

On the flip side, failure to breach the ascending support line will invalidate the downside move and instead allow the USDCAD to test the 1.3344 resistance line. Above this line lies the next upside target at 1.3432.

The EIA Crude Oil Inventories report is due for release in about half an hour. The figures could sway the price pendulum, so watch this report closely.