- The Ethereum price is down around 5% from Sunday's high of $4,458 and is in danger of erasing last week's rebound.

The Ethereum price is down around 5% from Sunday’s high of $4,458 and is in danger of erasing last week’s rebound. Ethereum (ETH) is softer in early Asian trading Monday, changing hands at $4,210 (-1.20%), a 7-day decline of -10%. The recent reversal has pushed ETH’s market cap below the $500 billion mark, but the tokens market dominance remains stable at 19.2%.

Similar to Bitcoin (BTC), Ethereum made a new high in November. Following an 80% three-week increase, ETH achieved a personal best of $4,950, just short of the psychological $5,000 threshold. But since then, the cryptocurrency market has lost around $400 billion in value, with the Ethereum price correcting around -16%. Subsequently, there are mixed signals as to whether the recent rally has run its course.

Encouragingly, ETH was bid aggressively from last week’s low of $3,865, climbing almost 15% to $4,456 over the weekend. However, the rally stalled on Sunday as sellers emerged ahead of $4,500. As a result, the price now looks likely to retest the $3,850 level.

ETH/USD Price Analysis

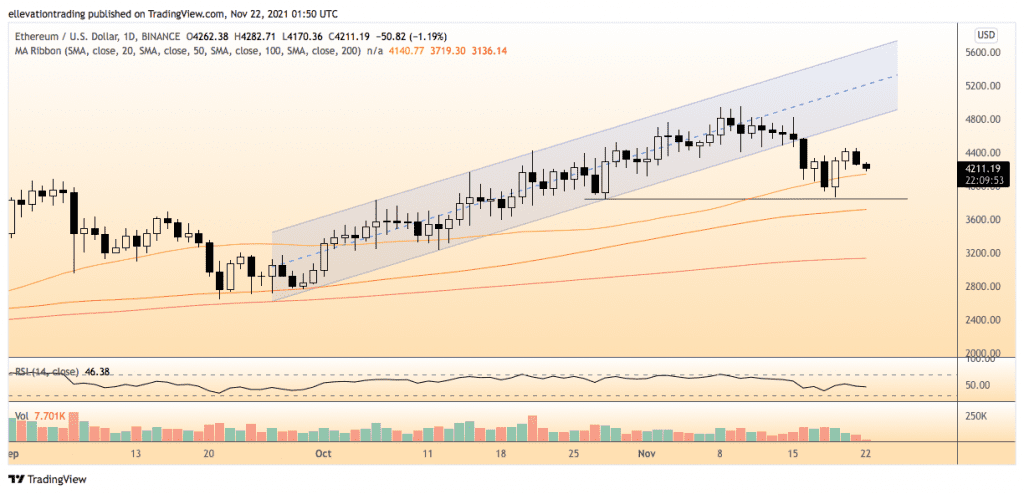

The daily chart shows that selling accelerated as soon as Ethereum broke below the rising trend channel support at $4,520. I expect ETH to trade with a bearish bias until it recovers the trend, now at $4,775. A logical target on the downside is the $3,850 area that provided the support for last week’s bounce.

However, if the Ethjereum price slides below $3,850, there is a chance of deeper correction towards the 200-Day Moving Average (DMA) at $3,135.

For now, the longer-term outlook is unclear, although, in the immediate future, I expect the Ethereum price to test the $3,850 support. However, a close above Saturday’s $4,456 high will invalidate the bearish view.

Ethereum Price Chart (Daily)

For more market insights, follow Elliott on Twitter.