- Summary:

- Leading DeFi-centric Fintech company, Cake DeFi, has announced the launch of its venture capital investment arm. We tell you what it brings.

DeFi-centric Fintech platform, Cake DeFi, has launched its corporate venture segment, setting aside $100 million in initial capital investment. The corporate venture arm, Cake DeFi Ventures (CDV), will spearhead Cake DeFi’s investments into startups. Interested projects can apply for funding by sending project details to [email protected].

The company targets investments across the Web3 and Metaverse markets. Particularly, it targets to invest in NFTs, e-sports, gaming, and Fintech. Notably, CDV will cast its nest wide and even target startups outside its native Singapore.

Startups joining the CDV portfolio can expect to gain access to various products, connections, resources, and a strong user base, courtesy of Cake DeFi. Also, they can expect to tap into the company’s resources, thanks to its status as Southeast Asia’s fastest-growing DeFi project. Additionally, the company is led by a reputable team with great influence across the blockchain ecosystem.

Co-founders Dr Julian Hosp, CEO, and U-Zyn Chua, CTO, have an enviable track record and experience in blockchain. Dr. Hosp is an accomplished blockchain entrepreneur and an influencer with more than one million followers across various channels. Similarly, U-Zyn is a blockchain engineer with more than ten years of experience in blockchain design, development, and investment.

Commenting on the launch of CDV, Julian Hosp, co-founder, and CEO of Cake DeFi, affirmed that the company will provide the necessary support to its partners. He added that the VC arm of the company would help it promote the mass adoption of cryptocurrencies and blockchain technology.

By launching Cake DeFi Ventures, we strive towards bringing cryptocurrency and blockchain capabilities to the world.”

Julian Hosp, Co-founder and CEO of Cake

About Cake DeFi

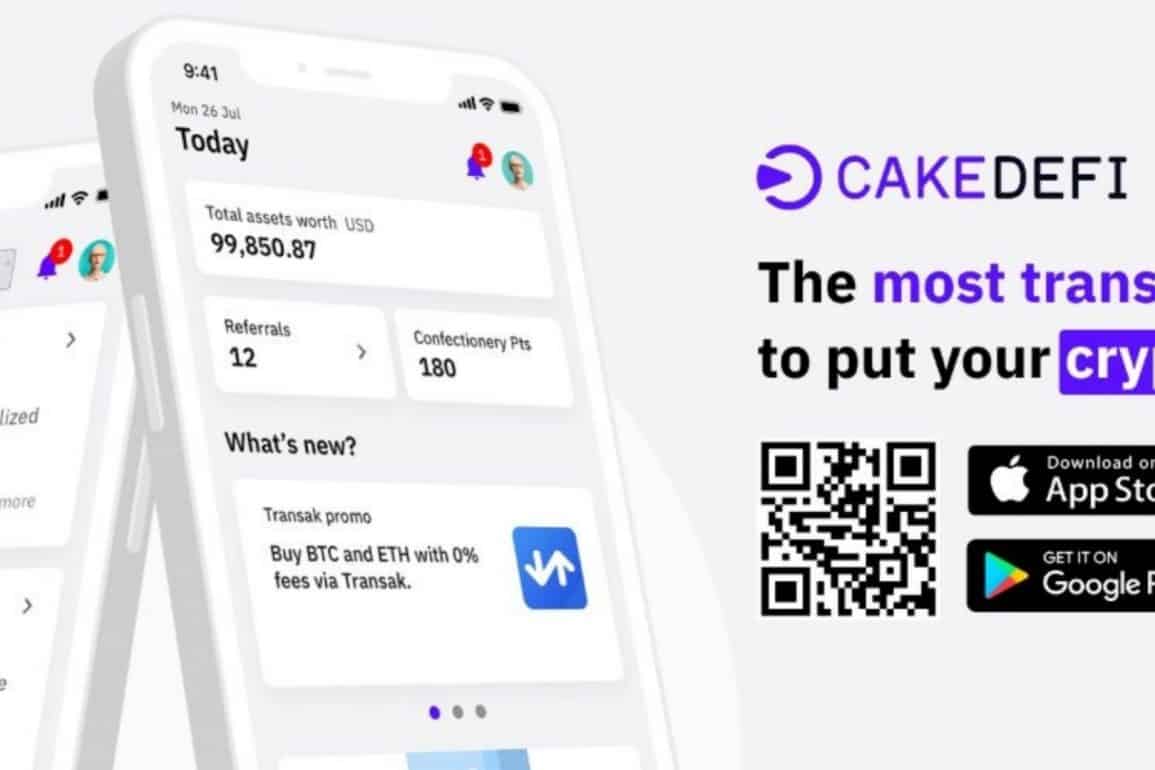

Cake DeFi is a Singapore-based regulated global Fintech platform with more than $1 billion in customer assets under management. It enables its increasing user base of over 500,000 registered users to profit from their digital asset investments in the form of recurring cash flow.

Its product line includes lending, liquidity mining, freezer, and staking. Also, the company intends to add loans feature to its product line in the first quarter of 2022.