- Summary:

- Following a 6-week rally, the CAC 40 index could be due for a correction as a rising wedge begins to form on the charts,

Mixed Eurozone inflation data did little to deter the bulls who were itching to recover Wednesday’s losses on the French stock market index. The CAC 40 index had lost 0.97% on Wednesday to wipe off the week’s gains so far.

However, the bulls added 0.45% to the CAC 40 index’s value on Thursday to recoup some of those losses, succeeding in keeping the index barely afloat for the week. However, the day’s gains stalled at a key resistance that has capped any further advances since the 29 April high at 6601.

The markets were looking for some additional direction from the Eurozone inflation data. However, the core and headline consumer price indices and the Harmonized Index of Consumer Prices (HIPC) data ended up mixed, with monthly figures showing a decline in consumer inflation but the annualized figures showing an increase from the 12 months prior. The mixed picture means that price direction for the Europen indices, including the CAC 40, will have to rely on other fundamental triggers for price direction.

The early July recovery of the CAC 40, primarily driven by the French economy’s expansion at the time, appears to be running out of steam and may be due for a correction. Whether this will happen at the current level depends on how traders handle the evolving chart pattern.

CAC 40 Index Forecast

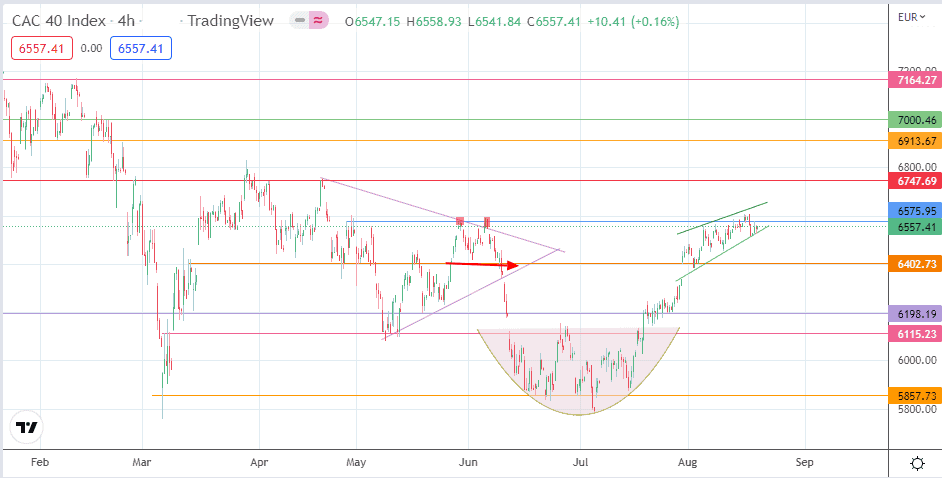

A rising wedge pattern is currently in evolution at the same resistance point. The stall of the price action at the 6575 resistance coincides with the previous double top pattern seen on 30 May and 6 June 2022 at the same price point.

A breakdown of the wedge’s lower border opens the gates for the bears to make a push toward 6402, the 3 August 2022 low, and the previous neckline of the double top. A further decline below this pivot makes 6198 available as a potential harvest point for the bears. 6115 and the 6000 psychological price mark are also potential targets to the south if there is a more profound correction.

On the flip side, a break above the 6575 resistance and the wedge’s upper border will invalidate the bearish position. Instead, 6747 (4 April and 21 April highs) will become the target of choice for the bulls. If the bulls take out this barrier, there will be clear skies ahead to aim for 6913 (4 February low) and potentially the 7000 psychological barrier and 18 February high.

CAC 40: Daily Chart