- Summary:

- Berenberg's bullish outlook on the Centamin share price remains intact as long as sky-high inflation drives gold demand.

The Centamin share price is down 3.11% on the day, as the stock gets hit by a round of profit-taking following six consecutive gains. The stock has seen a rally that has taken it from a low of 75.16p to the 22 June high of 84.34p. Therefore, it is not surprising to see some traders banking profits they have made in the last week.

The Centamin share price appeared to have been boosted by German investment bank Berenberg, which predicted a 28.1% potential upside to the stock on 31 May. At the time, the Centamin share price stood at 80.62. After a series of rallies and dips, the price is more or less the same as before, leaving the target price forecast intact. The price target set by Berenberg remains 114p.

But what is behind this bullish forecast even when the stock has underperformed in H1 2022? It is all about gold prices. The war in Ukraine and the upheaval it has brought to the global economy, and the stratospheric inflation levels in many countries, are driving demand for gold. At the height of the pandemic, Goldman Sachs predicted a $2300/ounce price. Yes, central banks have gotten aggressive with their rate hikes, but the impact on inflation is usually not immediate.

The underperformance of the Centamin share price is traceable to lower revenues and asset impairment. However, higher gold prices could offset these factors, validating Berenberg’s Centamin share price target.

Centamin Share Price Forecast

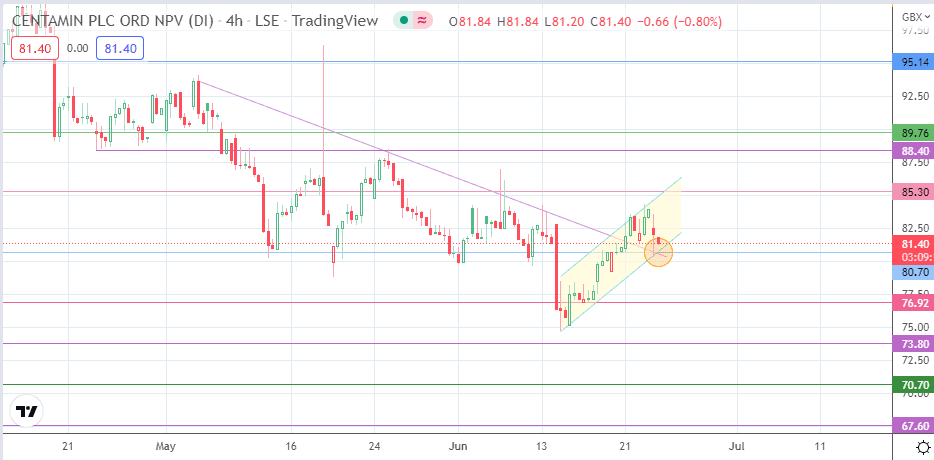

The 80.70 support level (31 May and 29 June 2022 lows) marks the point of convergence of the channel’s trend line and the descending trendline that connects the previous highs of 5 May, 25 May and 13 June 2022.

The bearish candle is now testing the encircled spot. A bounce at this point sends the pair towards the 85.30 resistance, formed by the previous high of 16 May 2022. A further ascent targets 88.40 (10 May and 25 May highs), before 89.76 enters the mix as an additional harvest point for the bulls.

The bullish outlook is invalidated if the price action breaks down the 80.70 support, taking out the supporting functions of the channel’s trendline and the descending trendline. This scenario sees 76.92 as the next target to the south, the previous low of 16 June 2022. Additional southbound marks are seen at 73.80 (10 February 2016 low) and 70.70, with an earlier high on 22 October 2015 and 4 February 2016.

Centamin: Daily Chart