Cryptocurrencies are experiencing some wild moves in the last 24 hours. Bitcoin (BTCUSD) turned parabolic from mid-June and earlier this week headlines clearly showed a uber-bullish mood, with writers and analyst saying that investors should forget about the $19,650 all-time high and instead target the $100,000 mark. Well, as it is rather typical when the mood is at top the price of the underlying market tends to be at its highest, and bitcoin had at one point lost about $2635 per coin from its 24-hour peak. The decline amounted to a 19% drop. In the grand scheme of things, the latest decline is merely a blip for early investors that were at the time of writing still up by $8613 per coin from the February lows of $3305.

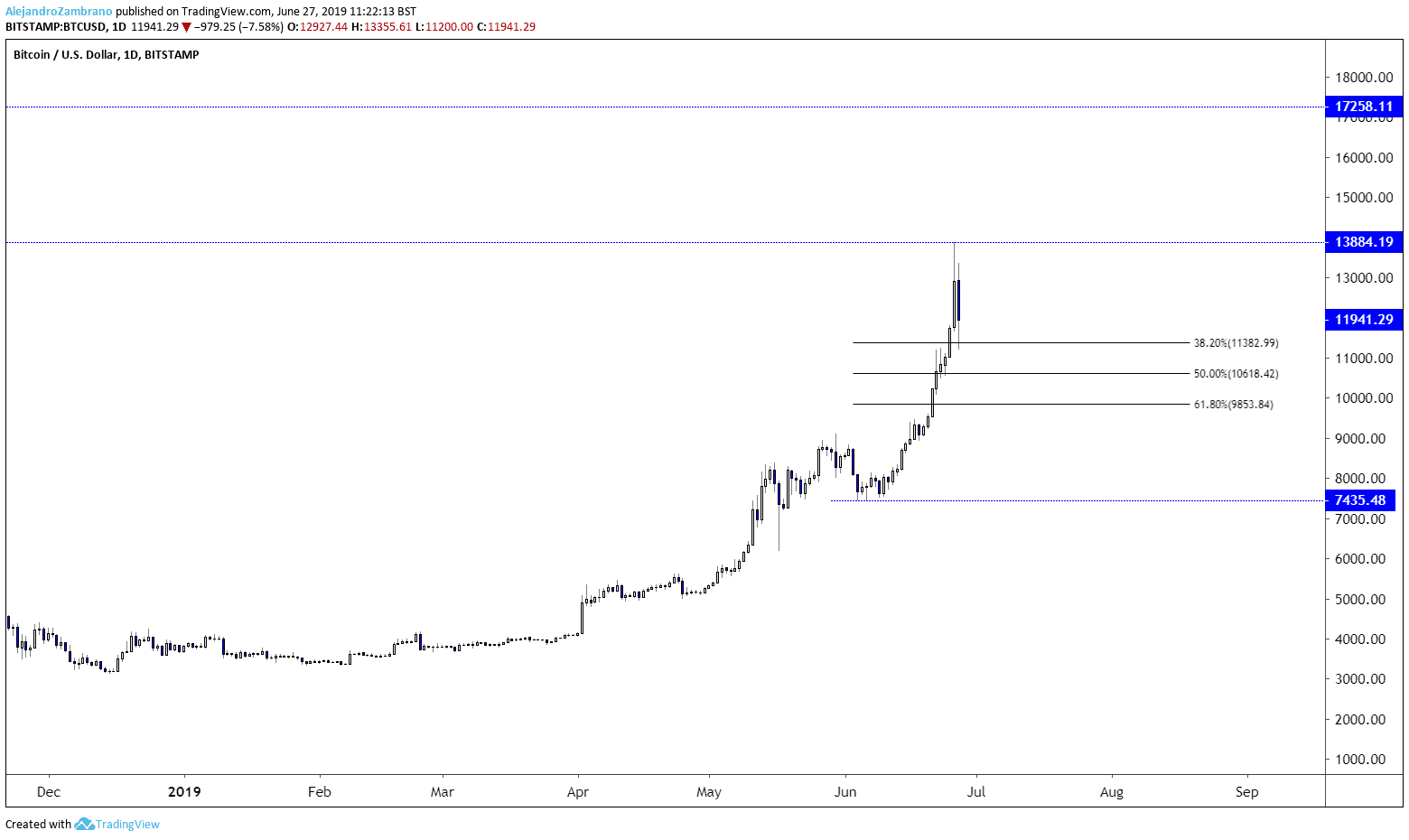

The next few days should be wobbly for investors and price, as some see the latest slide as an opportunity to buy, while some early investors are cashing out on the 2019 rally. However, as long as the price trades above the latest major low and likewise June 4 low of $7435.5 the overall trend in Bitcoin (BTCUSD) will remain bullish. Levels that might offer support to buyers are the three Fibonacci levels of the June rally at $11382, $10618, and $9853, which are the 38.2%, 50%, and 61.8% corrections respectively.

Don’t miss a beat! Follow us on Twitter.